Today on the CME there was no movement on butter. Hoogwegt has been, for all practical purposes, the sole player in moving butter down by way of offers. Butter has fallen over 45 cents in the past seven days. Does Hoogwegt make butter? No. Is there too much butter? No. Is this the market at work? No.

On what might be considered a more positive note, Kraft has been an active player in moving the price of barrels higher. Wonders never cease.

Tuesday, November 30, 2010

Monday, November 29, 2010

Glut

(click on image to enlarge)

Here is another article I find disturbing: http://www.bloomberg.com/news/2010-11-29/milk-glut-ruins-u-s-dairy-farm-profits-as-48-corn-rally-boosts-feed-cost.html

The article states: "Dairy farmers expanded herds following the 70 percent jump in prices to a record in 2007, just before the U.S. began its longest recession since before World War II and unemployment rose to the highest level in a quarter century." Did all dairy farmers expand herds in 2007? No. Could a competent rural sociologist shed some light on who did and who did not expand production?

Furthermore, As the above graph plainly shows, milk production had been climbing fairly steadily for several years, including years of low milk price.

Sunday, November 28, 2010

Wisconsin Survey

At: http://www.nass.usda.gov/Statistics_by_State/Wisconsin/Publications/Dairy/Dairy_OP_Release_10.pdf

is a very recent survey of dairy operations in Wisconsin.

Some of the information is broken down by farm size.

This reminds me of a game theory called "Prisoners Dilemma"

http://en.wikipedia.org/wiki/Prisoner%27s_dilemma

"The prisoner's dilemma is a fundamental problem in game theory that demonstrates why two people might not cooperate even if it is in both their best interests to do so."

As the "prisoners dilemma" is generally discussed, only the actions of the players are mentioned. There are however, external forces to the players. What should be the role of the state or federal governments in fostering cooperation? Oh no! That would never do. We need competition. Those who advocate this always think some unknown person will lose. It is never a close friend or relative.

is a very recent survey of dairy operations in Wisconsin.

Some of the information is broken down by farm size.

This reminds me of a game theory called "Prisoners Dilemma"

http://en.wikipedia.org/wiki/Prisoner%27s_dilemma

"The prisoner's dilemma is a fundamental problem in game theory that demonstrates why two people might not cooperate even if it is in both their best interests to do so."

As the "prisoners dilemma" is generally discussed, only the actions of the players are mentioned. There are however, external forces to the players. What should be the role of the state or federal governments in fostering cooperation? Oh no! That would never do. We need competition. Those who advocate this always think some unknown person will lose. It is never a close friend or relative.

Saturday, November 27, 2010

FAO Outlook

The Food and Agricultural Organization of the UN has recently release its world food out report. The report is avail at: http://www.fao.org/docrep/013/al969e/al969e00.pdf

This is a big file and takes some time to download.

Dairy begins on page 51 with:

With prices "firm" who needs risk management? However, those are world prices

This is a big file and takes some time to download.

Dairy begins on page 51 with:

The monthly FAO price index of international dairy products,

which consists of a basket of export prices in Oceania for

whole milk powder (WMP), butter, skim milk powder (SMP)

and cheese, has remained firm so far in 2010, in contrast

with the significant swings observed in the past two years.

The FAO index was 198 in September 2010, similar to its

level in January 2010 but 38 percent higher than the average

for 2009. While this represents a strong recovery from

last year, it still remains 20 percent below its peak value in

early 2008. However, compared with the base period of

2002–04, prices have doubled. Export prices in Oceania in

September 2010 were USD/tonne 4 100 for butter, 3 140 for

SMP, 3 360 for WMP and 3 950 for cheese.

With prices "firm" who needs risk management? However, those are world prices

Friday, November 26, 2010

China's Food Crisis

Exports of U.S. dairy products are way up. china has increased imports to dairy products from the U.S. by nearly 48%. This has not really helped the U.S. dairy farmers financially. Meanwhile, much of the rise in feed costs can be attributed to corn and soy exports to China.

China has some worries: http://blogs.wsj.com/chinarealtime/2010/11/26/china%E2%80%99s-inflationary-food-fight/

There have been riots, small riots in China over food prices. The Chinese government can always call out the army but, the stability of the government depends upon the people prospering. Things look worrisome.

When the world financial crisis hit, the American dairy farmer took a hit. This was because, those in power could take it out of the farmers hide. Meanwhile, there has been no change in dairy pricing policy. As the clock ticks, what looks like the future is NMPF plan to essentially maintain the status quo. Too bad!

China has some worries: http://blogs.wsj.com/chinarealtime/2010/11/26/china%E2%80%99s-inflationary-food-fight/

There have been riots, small riots in China over food prices. The Chinese government can always call out the army but, the stability of the government depends upon the people prospering. Things look worrisome.

When the world financial crisis hit, the American dairy farmer took a hit. This was because, those in power could take it out of the farmers hide. Meanwhile, there has been no change in dairy pricing policy. As the clock ticks, what looks like the future is NMPF plan to essentially maintain the status quo. Too bad!

Thursday, November 25, 2010

Thanksgiving Day

(click on image to enlarge)

Today is Thanksgiving day. In spite of the fact that is much to complain about, there is always something, usually many things, to be thankful for.

I personally, am very thankful for all those who take time to read this blog. The map above shows internet providers, not individual readers on a typical day reading this blog. Those who read the blog come from all walks. A law student told me she reads the blog everyday. USDA has its own IP and I can see that on many days USDA logs in over eleven hours.

So, I want to thank everyone and hope everyone has had a great Thanksgiving.

Wednesday, November 24, 2010

Real Names

There is an ancient saying, "The beginning of wisdom is to call things by their real names."

So: http://www.capitalpress.com/dairy/CRD-dairy-risks-w-art-112610

The article quotes Ed Gallagher, Dairy Farmers of America's vice president of economics and risk management.

Gallagher has the ability to know when butter has fallen $0.515 since the first of the month who did the dirty deed. DFA knows how easy it is to manipulate the CME - they got caught. DFA has not participated in the cash market since January 2009. CFTC has a person assigned to watch DFA at the CME. But, has DFA repented from their ways of leading farmers to think there is a real market?

So: http://www.capitalpress.com/dairy/CRD-dairy-risks-w-art-112610

The article quotes Ed Gallagher, Dairy Farmers of America's vice president of economics and risk management.

"We've got to do better yet," he said. "The market doesn't care what anybody's cost of production is. The long-run average price will just about equal long-run costs."

Margins keep tightening, and they're likely to tighten further.

Gallagher has the ability to know when butter has fallen $0.515 since the first of the month who did the dirty deed. DFA knows how easy it is to manipulate the CME - they got caught. DFA has not participated in the cash market since January 2009. CFTC has a person assigned to watch DFA at the CME. But, has DFA repented from their ways of leading farmers to think there is a real market?

Tuesday, November 23, 2010

Farming Systems

(click on image to enlarge)

In an early form of writing known as Runes, some experts claim the first word or symbol meant both wealth and cattle.

The above graph is from a report by the European Food Safety Authority titled "Scientific Report on the effects of farming systems on dairy cow welfare and disease."

A lot has changed. Dairy farming has become just another extractive industry, taking a toll on both man and beast.

Monday, November 22, 2010

Butter

(click on image to enlarge)

NASS released its "Cold Storage" report today:

http://www.usda.gov/nass/PUBS/TODAYRPT/cost1110.pdf

Cheese is up but then, so are the MPC imports - what's new.

But, butter "Butter stocks were down 17 percent from last month and down 43 percent from a year ago." Naturally, butter prices fell $0.09 per pound on one offer. No, the offer was not from a butter maker. Isn't the market system just swell?

http://www.hoogwegtus.com/

"Our Core Values:

We are serious about INTEGRITY . . ."

Sunday, November 21, 2010

Monetary Policy

One of the most important sets of data to follow is the U.S. Dollar Index. The U.S is in a bind. With high debt levels, the U.S. needs to export more products. When the Almighty Dollar was high, we imported a great deal. Monetary policy is a key factor driving the value of the dollar. Under Reagan, interest rates were driven up to slow inflation. As a matter of fact, that policy destroyed manufacturing in America.

So now, interest rates are in the basement, for those who can borrow, and the value of the dollar against other currecies has fallen dramatically.

China's currency is fixed. Essentially, this has created an artificially low exchange rate, which, as long as the U.S. Dollar was high, China's economy grew by leaps and bounds.

The Feds "quantitative easing" has lowed the value of the dollar which in turn impacts china's economy downward. Since, November 12, 2010 corn at the CBOT has lost 8% value. Soy at the CBOT has lost 10%.

Good for those who buy grain.

But, fertilizer imports (quantities)have risen 75% in the first nine months of this year and the prices are rising too. The same can be said of fuel.

While it is all well and good to talk about "risk Management", the total number of risk are unknown. Under those conditions, someone had better get a grip on the activity on the CME.

So now, interest rates are in the basement, for those who can borrow, and the value of the dollar against other currecies has fallen dramatically.

China's currency is fixed. Essentially, this has created an artificially low exchange rate, which, as long as the U.S. Dollar was high, China's economy grew by leaps and bounds.

The Feds "quantitative easing" has lowed the value of the dollar which in turn impacts china's economy downward. Since, November 12, 2010 corn at the CBOT has lost 8% value. Soy at the CBOT has lost 10%.

Good for those who buy grain.

But, fertilizer imports (quantities)have risen 75% in the first nine months of this year and the prices are rising too. The same can be said of fuel.

While it is all well and good to talk about "risk Management", the total number of risk are unknown. Under those conditions, someone had better get a grip on the activity on the CME.

Saturday, November 20, 2010

Legal Term of the Day

http://www.nolo.com/dictionary/adhesion-contract-(contract-of-adhesion)-term.html

adhesion contract (contract of adhesion)

In a very few situations dairy farmers have no contracts with their milk handler. In places where there is competition, the contract in often month-to-month. In the Northeast and elsewhere the contracts are for a year.

So, I suspect that many of the one year contracts are actual "adhesion contracts." The problem with adhesion contracts is the person on the bottom often (usually) has no resources to fight a case in court.

adhesion contract (contract of adhesion)

A contract that so strongly favors one party or so unfairly restricts another, that it creates a presumption that one party had no choice when entering into it. If a court determines that the contract is overly unfair, it may refuse to enforce the agreement against the disadvantaged party. An example of a contract of adhesion might be a form contract provided by an unethical leasing company. Adhesion contracts are often evidenced by the comparative strength of the parties-- for example, a giant corporation as compared to an average citizen.

In a very few situations dairy farmers have no contracts with their milk handler. In places where there is competition, the contract in often month-to-month. In the Northeast and elsewhere the contracts are for a year.

So, I suspect that many of the one year contracts are actual "adhesion contracts." The problem with adhesion contracts is the person on the bottom often (usually) has no resources to fight a case in court.

Friday, November 19, 2010

Not Enough

Today USDA released its "Outlook" report, which can be found at: http://www.ers.usda.gov/Publications/LDP/2010/11Nov/LDPM197.pdf

Here is the conclusion for dairy:

The report mentions higher feed prices but, there is no mention of the pricing system being broken.

Here is the conclusion for dairy:

Stronger NDM prices should partly offset lower butter prices, keeping Class IV prices firm over the course of 2011. Class IV prices, which are expected to average $14.45 to $15.45 per cwt in 2011, will be only slightly lower than the expected $15.05 to $15.25 per cwt average in 2010. Stronger domestic demand for cheese will boost the Class III price next year. In 2011, the Class III price is expected to average $14.40 to $15.30 per cwt, up from an average $14.35 to $14.45 this year. The all milk price is forecast to average $15.95 to $16.85 per cwt next year, very near the expected 2010 average of $16.30 to $16.40 per cwt.

The report mentions higher feed prices but, there is no mention of the pricing system being broken.

Thursday, November 18, 2010

Milk Production & Belief

(click on image to enlarge)

Today, the USDA'S "Milk Production" report came out. According to USDA production in the 23 lead dairy states was up 3.3 percent in October 2010. Who knows. Certainly some expert will use the data to suggest that the drop in price at the CME is justified. Those who believe in this drivel also believe the market system regulates supply and demand through price. Wrong.

Note: The 2011 data is USDA's projections

Wednesday, November 17, 2010

Heirarchy

(click on image to enlarge)

If you go to Wal-Mart's investor presentation at: http://media.corporate-ir.net/media_files/irol/11/112761/Transcripts/3Q11_transcript.pdf

on page 15 is: "Produce and dairy were our strongest categories." Note above what Dean is saying.

Supermarkets wear the pants in the dairy industry - they are on top. Next comes the processors and the farmers get what is left.

Tuesday, November 16, 2010

Not Goumet

http://www.stuff.co.nz/business/industries/4332036/Fonterras-added-value-plan-paying-off

Fonterra's added-value plan paying off

Fonterra ingredient technology + California's cheap milk = profit for someone but, the stuff wont win any prizes.

Fonterra's added-value plan paying off

Fonterra's strategy of adding value to other countries' milk to bring home fatter returns to New Zealand has made major strides in the United States, and a successful cheese and yoghurt ingredient manufacturing experiment is now being rolled out in Europe.

Using leased plant and milk supplied from US heavyweight co-operative California Dairies, Fonterra has made a cheddar cheese production breakthrough by applying Kiwi intellectual property from its Palmerston North research centre.

The new products would command premium prices in world food service markets, said Andrei Mikhalevsky, managing director, global ingredients and food services.

The venture has so far cost Fonterra US$7.5 million (NZ$9.6m), mainly to upgrade the ageing plant. Building a new factory would have cost up to US$70m, he said.

The first season's production of the new Cheddar Plus brand was small at about 13,000 tonnes but quickly sold out.

Production of a specialised yoghurt base at the same plant at Los Banos, between Los Angeles and San Francisco, has been similarly successful, though sales had been later starting because of US grading certification requirements.

"The cheese is basically a cheese ingredient that people would put into sliced cheese for application into the food service, where it might be used for hamburgers or cheddar slices for retail," Mr Mikhalevsky said.

He declined to forecast likely earnings from the new venture, but said Fonterra was aiming for a big slice of the US$19 billion world cheese ingredient market. T

he global market for all cheese is estimated to be worth US$91b.

"We have proved the model. We are not just talking about value-add, we have proved the concept. It's not a dream, it's now a reality."

The hunt is on for plants in Europe.

Fonterra ingredient technology + California's cheap milk = profit for someone but, the stuff wont win any prizes.

Monday, November 15, 2010

Straight PR

At:

http://www.prnewswire.com/news-releases/dairy-management-inc-and-americas-dairy-farmers-set-the-record-straight-107951839.html

Is:

Dairy Management Inc. and America's Dairy Farmers Set the Record Straight

But, but wait... on May 23, 2005 the U.S. Supreme Court:

"Held: Because the beef checkoff funds the Government’s own speech, it is not susceptible to a First Amendment compelled-subsidy challenge."

this case applied to "all" checkoff challenges, including dairy.

There is little doubt but that the top DMI people remember the Supreme Court shoring up their massive salaries. Talk about setting the record straight?

http://www.prnewswire.com/news-releases/dairy-management-inc-and-americas-dairy-farmers-set-the-record-straight-107951839.html

Is:

Dairy Management Inc. and America's Dairy Farmers Set the Record Straight

ROSEMONT, Ill., Nov. 14, 2010 /PRNewswire/ -- The New York Times and numerous media outlets this past week have inaccurately reported on the nation's farmer-funded dairy promotion program. Much of the reporting is fundamentally wrong. Contrary to the myth that has been perpetuated, Dairy Management Inc. was not created by the U.S. Department of Agriculture (USDA), nor is it an agency of USDA. It is a private, non-profit corporation created -- and run -- by America's dairy farmers who established it to unify national and local dairy promotion efforts.

All of the programs created by Dairy Management Inc. to promote dairy consumption in the U.S. are paid for completely by America's dairy farmers. No taxpayer dollars are used for our domestic marketing efforts. USDA does not contribute money to promote dairy products in the U.S. In fact, dairy farmers actually pay USDA for all of the costs to oversee the promotion program.

USDA performs a congressionally mandated oversight role over the collection and disbursement of dairy farmer's funds, and to ensure that our programs are consistent with the law that set up the program.

America's dairy farmers are proud of the nutritional contributions of milk and cheese to the U.S. diet and support the consumption of a balanced diet which includes room for all foods in moderation. The U.S. government's Dietary Guidelines for Americans, which call for the consumption of three servings of low-fat or fat-free milk products each day, are the cornerstone of Dairy Management's nutrition guidance.

The 56,000 dairy farm families represented by Dairy Management welcome and encourage people to learn more about the important dietary role of dairy in supplying nine key nutrients necessary for healthy bodies and welcome inquiries about their efforts to promote increased dairy consumption so that Americans get their three servings of dairy a day.

Efforts to misrepresent this program, and the federal government's role in administering the program, are an unfortunate and unacceptable assault on the hard work and dedication of America's dairy farmers.

But, but wait... on May 23, 2005 the U.S. Supreme Court:

"Held: Because the beef checkoff funds the Government’s own speech, it is not susceptible to a First Amendment compelled-subsidy challenge."

this case applied to "all" checkoff challenges, including dairy.

There is little doubt but that the top DMI people remember the Supreme Court shoring up their massive salaries. Talk about setting the record straight?

Sunday, November 14, 2010

Get Together

No one keeps any statistics on how many times dairy farmers are told they need to get together.

Looking at Barry Wilson's "Dairy Industry Newsletter" (on-line and print subscription = $1,000/year)I noticed a further breakdown of the data produced by Hoards on the 50 largest cooperatives.

Barry notes some of the largest producer co-ops, in terms of volume per farm, expanded production in 2009. Continental, for instance, produced 5% more per farm. So much for meaningful markets signals. The average Continental produced 61.44 million pounds in 2009.

Ten of those farm would produce all of the of the milk produced by 727 Lanco farmers.

So, would America be better off if more than 700 Lanco farmers went out of business? I think not.

So what exactly is meant by the idea of all dairy farms getting together? I personally think that is code for there will be no meaningful discussion of the complexities of dairy in high places.

Looking at Barry Wilson's "Dairy Industry Newsletter" (on-line and print subscription = $1,000/year)I noticed a further breakdown of the data produced by Hoards on the 50 largest cooperatives.

Barry notes some of the largest producer co-ops, in terms of volume per farm, expanded production in 2009. Continental, for instance, produced 5% more per farm. So much for meaningful markets signals. The average Continental produced 61.44 million pounds in 2009.

Ten of those farm would produce all of the of the milk produced by 727 Lanco farmers.

So, would America be better off if more than 700 Lanco farmers went out of business? I think not.

So what exactly is meant by the idea of all dairy farms getting together? I personally think that is code for there will be no meaningful discussion of the complexities of dairy in high places.

Saturday, November 13, 2010

Government

One cannot look at recent trading on the CME without questions coming to mind about the function of government.

Some hold that government is all about protection, particularly property, and those with the most to protect get the lions share of the governments attention. Adam Smith, the so-called father of capitalism, suggested the same and said those with the most to protect should pay the most in taxes. Maybe someone in the Tea Party mentioned Smith's view but, I don't recall hearing such.

Mostly, it seems the big push is for low taxes and less government.

However, Aristotle said, "It is in justice that the ordering of society is centered."

It is quite possible to have tyranny and have the rich and powerful shielded from harm.

A civil society, particularly one which claims to be a democracy, must truly focus on Justice.

I honestly don't see that happening in dairy.

Some hold that government is all about protection, particularly property, and those with the most to protect get the lions share of the governments attention. Adam Smith, the so-called father of capitalism, suggested the same and said those with the most to protect should pay the most in taxes. Maybe someone in the Tea Party mentioned Smith's view but, I don't recall hearing such.

Mostly, it seems the big push is for low taxes and less government.

However, Aristotle said, "It is in justice that the ordering of society is centered."

It is quite possible to have tyranny and have the rich and powerful shielded from harm.

A civil society, particularly one which claims to be a democracy, must truly focus on Justice.

I honestly don't see that happening in dairy.

Friday, November 12, 2010

Feed

At: http://usda.mannlib.cornell.edu/usda/current/FDS/FDS-11-12-2010.pdf

is the most recent "Feed Outlook", which begins:

I am not confident the current situation will be short term.

The Kansas Cit Federal Reserve just came out with a new report on "farmland investment." The report is at: http://www.kansascityfed.org/publicat/research/indicatorsdata/agcredit/AGCR3Q10.pdf

Here's an interesting quote from a bank, "Land fever is running rampant. It appears that the combination of low investment returns for financial assets and the generally strong farm sector has spurred a voracious appetite for agricultural land.‖ –NE Kansas"

is the most recent "Feed Outlook", which begins:

Lower forecast corn yields this month reduce U.S. corn production 124 million bushels to 12.54 billion. Fractional changes are made in sorghum, barley, and oats because of late harvests. Corn used for ethanol production is raised. Corn used domestically for feed and residual and for export are both lowered. These supply and use changes reduce projected ending stocks 75 million bushels. As projected, 2010/11 ending stocks would be the lowest since1995/96 and represent a carryout of 6.2 percent of projected usage. Price prospects for corn and sorghum are up this month. Foreign corn production is projected higher, with increased corn production in China. Rising foreign consumption combines with the smaller U.S. crop to leave global corn stocks at a 4-year low.

I am not confident the current situation will be short term.

The Kansas Cit Federal Reserve just came out with a new report on "farmland investment." The report is at: http://www.kansascityfed.org/publicat/research/indicatorsdata/agcredit/AGCR3Q10.pdf

Here's an interesting quote from a bank, "Land fever is running rampant. It appears that the combination of low investment returns for financial assets and the generally strong farm sector has spurred a voracious appetite for agricultural land.‖ –NE Kansas"

Thursday, November 11, 2010

2+2 = ?

The trade data came out yesterday. Altogether, the U.S. exported 4% more dairy product Jan - September 2010 than the same period in 2008.

The most recent "Commercial Disappearance" numbers only cover through August. Close enough. January through August of 2008 the milk equivalent was 127,432

(x 1 million) pounds. In 2010 it was 129,627 (x 1 million) pounds.

The average "all milk" price for January through September 2008 was $18.83 and for January through September 2010 it was $15.52 per hundredweight.

It really does not add up.

"In the case where it is a form of theft, distinguishing between embezzlement and larceny can be tricky." Wikipedia

The most recent "Commercial Disappearance" numbers only cover through August. Close enough. January through August of 2008 the milk equivalent was 127,432

(x 1 million) pounds. In 2010 it was 129,627 (x 1 million) pounds.

The average "all milk" price for January through September 2008 was $18.83 and for January through September 2010 it was $15.52 per hundredweight.

It really does not add up.

"In the case where it is a form of theft, distinguishing between embezzlement and larceny can be tricky." Wikipedia

Wednesday, November 10, 2010

Trade Data

You can probably go to many sites to see information on September's exports of dairy products. We exported a lot. We exported 3.2% of all cheese production. We exported 75.8% of all NFDM/SMP production.

Of course, we imported 67% more MPCs in September than we imported in September 2009. For the year-to-date we imported 8.3% more MPCs. Made a lot more cheese with all those MPCs.

Of course, we imported 67% more MPCs in September than we imported in September 2009. For the year-to-date we imported 8.3% more MPCs. Made a lot more cheese with all those MPCs.

Tuesday, November 9, 2010

Dean

http://www.cnbc.com/id/40086665

"These results are clearly disappointing for us and reflect continued significant challenges in our largest business, Fresh Dairy Direct-Morningstar," said Gregg Engles, Chairman and Chief Executive Officer."

Kraft is having cash flow problems and now Dean. Any mystery regarding where they expect the money to come from?

"These results are clearly disappointing for us and reflect continued significant challenges in our largest business, Fresh Dairy Direct-Morningstar," said Gregg Engles, Chairman and Chief Executive Officer."

Kraft is having cash flow problems and now Dean. Any mystery regarding where they expect the money to come from?

Monday, November 8, 2010

Who Knows?

What is happening on the CME? Last week Kraft came and traded a few loads of cheese. Jerome, which might be simply following has sold the most loads. Mullins has traded a few loads. None of this answers the question of why? I think the following might be a key.

http://www.cnbc.com/id/38241893

Kraft needs cash and it is OK with the government if the powerful take what they need from those with less power.

Near as I can find Hoogwegt (http://www.hoogwegtus.com/) offered the butter Friday and AMPI bought the load.

The seller does not make butter. The buyer does. Is that a real market? I think NOT.

Today, it appears that Dairygold bid the price back up 12 cents. Probably in an effort to protect the value of their inventory. Once again a producer of butter is bidding.

The 1996 study on the National Cheese Exchange repeatedly referred to "trading against interest" as a sign of market failure.

The election is over and it seems there was a clambering for less government. Is there anyone holding their breathe while the government contemplates the dairy trading on the CME?

http://www.cnbc.com/id/38241893

More than 150 companies with market caps above $500 million that claim they have free cash flow—really don't!

That's the word from Ken Hackel, who wrote the just-published tome (and I do mean tome): "Security Valuation and Risk Analysis – Assessing Value in Investment Decision Making."

You should care, because free cash flow is the lifeblood of any company looking to grow.

And free cash flow was touted as a plus quite a bit in the recent round of earnings.

Hackel isn’t impressed. "The term 'free cash flow' has almost gotten to be like the old television show 'What's My Line',” he says. “What free cash flow should be defined as is the maximum amount of cash an entity could distribute to its shareholders without impairing its growth rate. Unfortunately, we've gotten quite a bit away from that."

The free cash flow definition most people use is operating cash flow minus capital spending.

But Hackel says that true free cash flow requires a lot more in the way of adjustments—the kind he believes most analysts simply do not do.

Among companies whose cash flow he believes are flashing red:

Kraft [KFT 31.12 0.04 (+0.13%) ], whose revenues missed estimates and which didn’t include a cash flow statement with its earnings release or discuss it on its earnings call. Still, using available information, Hackel believes he was able to analyze the cash flow and say, “Their backs are really against the wall; they have no room for expansion; they do not have financial flexibility."

Kraft disagrees, saying that over the past few years it has made excellent progress improving free cash flow. "In 2010, there are a number of puts and takes in the equation, due to the acquisition of Cadbury. However, on a more normal run-rate basis, we would expect cash flow to be north of about $3.5 billion.”

Kraft needs cash and it is OK with the government if the powerful take what they need from those with less power.

Near as I can find Hoogwegt (http://www.hoogwegtus.com/) offered the butter Friday and AMPI bought the load.

The seller does not make butter. The buyer does. Is that a real market? I think NOT.

Today, it appears that Dairygold bid the price back up 12 cents. Probably in an effort to protect the value of their inventory. Once again a producer of butter is bidding.

The 1996 study on the National Cheese Exchange repeatedly referred to "trading against interest" as a sign of market failure.

The election is over and it seems there was a clambering for less government. Is there anyone holding their breathe while the government contemplates the dairy trading on the CME?

Sunday, November 7, 2010

Restaurants

(click on image to enlarge)

The good news is that full service restaurants are doing quite well - at least according to the Bloomberg Index.

However, the New York Times has an article should be read:

http://www.nytimes.com/2010/11/07/us/07fat.html?pagewanted=1&_r=1&hpw

The article has generated a great deal of backlash against dairy farmers on Twitter. Naturally, the article should be of concern. But, has the increase in per capita cheese consumption really benefited dairy farmers?

Funny, there seems to be no problem in France with cheese consumption and obesity.

Saturday, November 6, 2010

Dollar

(click on image to enlarge)

Since we live in a global economy (like it or not), the relative value of the U.S. dollar is important to dairy farmers.

On the one hand, imports of most dairy products will be curbed. But, exports of grains, particularly soy and corn, will be driven by a low U.S. dollar. So, don't count on cheap grain anytime in the near future.

Friday, November 5, 2010

How Low?

By asking the question, how low, I do not intend to guess out future CME prices. The question I am asking is how low will the powerful stoop relative to human decency.

Today's CME prices indicate there is no honor among the thieves. Trading a few loads on the CME impacts supply/demand hardly at all. Anything traded on the CME could be traded off the CME. This can and does happen all the time. The only thing trading at the CME really affects is farm milk price.

December Class III is $13.56.

Blocks today are $1.48. For comparison world price (FOB Oceania) is is $1.86.

Butter fell $0.27 today to close on the CME at $1.88. World price for butter adjusted to 80% butterfat is $2.32. No One can make the case that there is too much butter.

Today's CME prices indicate there is no honor among the thieves. Trading a few loads on the CME impacts supply/demand hardly at all. Anything traded on the CME could be traded off the CME. This can and does happen all the time. The only thing trading at the CME really affects is farm milk price.

December Class III is $13.56.

Blocks today are $1.48. For comparison world price (FOB Oceania) is is $1.86.

Butter fell $0.27 today to close on the CME at $1.88. World price for butter adjusted to 80% butterfat is $2.32. No One can make the case that there is too much butter.

Thursday, November 4, 2010

Farm Milk Prices

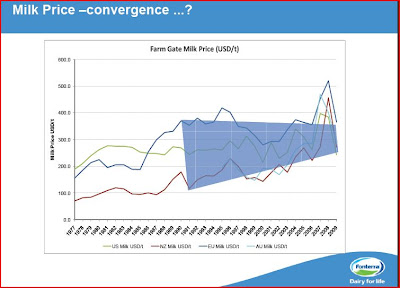

(click on image to enlarge)

Note: I enlarged the section (11/06/10) to show the detail better. U.S. is the green line and NZ the red line.

Take a close look at the above graph. Where is New Zealand's farm milk price relative to the U.S.? The above graph by Fonterra does not show 2010 but, it is higher for NZ.

Wednesday, November 3, 2010

What's Happening

http://www.marketintelligencecenter.com/newsbites/1221395

"Kraft Foods (NYSE: KFT) opened at $31.81. So far today, the stock has hit a low of $31.59 and a high of $32.00. KFT is now trading at $31.67, down $0.17 (-0.53%). The stock hit its 52-Week high of $32.67 in October and set its 52-Week low of $26.31 last November. The company will report Q3 earnings tomorrow, with analysts expecting to see $0.46 per share, versus $0.55 during the same period last year. Technical indicators for the stock are neutral and S&P gives KFT a neutral 3 STARS (out of 5) hold ranking. If you are looking for a hedged play on KFT the stock seems like it could be a candidate for a January out-of-the-money bull-put credit spread below the 28 range."

Crashing prices on the CME might seem like a good plan, except...there will be a train wreck. This is not capitalism at work, this is power, raw power.

"Kraft Foods (NYSE: KFT) opened at $31.81. So far today, the stock has hit a low of $31.59 and a high of $32.00. KFT is now trading at $31.67, down $0.17 (-0.53%). The stock hit its 52-Week high of $32.67 in October and set its 52-Week low of $26.31 last November. The company will report Q3 earnings tomorrow, with analysts expecting to see $0.46 per share, versus $0.55 during the same period last year. Technical indicators for the stock are neutral and S&P gives KFT a neutral 3 STARS (out of 5) hold ranking. If you are looking for a hedged play on KFT the stock seems like it could be a candidate for a January out-of-the-money bull-put credit spread below the 28 range."

Crashing prices on the CME might seem like a good plan, except...there will be a train wreck. This is not capitalism at work, this is power, raw power.

Tuesday, November 2, 2010

Election Predictions

At this point in time, one can safely bet, with the elections nearly over, we can go back to nothing happening in dairy policy. How many ways can "gridlock" be spelled.

Unfortunately,looking at today's CME, big trouble is on the way.

Unfortunately,looking at today's CME, big trouble is on the way.

Monday, November 1, 2010

Reason

(click on image to enlarge)

The seventeenth century is known as the age of reason. Descartes (1596 - 1650) famously said, "I think therefore I am." Quite some time passed before thinking became something to be manipulated.

Obviously, there are large stocks of cheese. So, the fact that today Kraft indicated the price of cheese (actually farm milk) should fall. The argument put forth will be centered on stocks.

But, if the consumer sees no indication of cheese stocks, what really happened today, and for the past several days, is those in the middle will profit. As can be seen in the graph above, there is no correlation between retail Cheddar and cheese stocks. There is a similarity in the trend. Consumer prices and cheese stocks both trend up.

Descartes essay from which the famous quote comes is filled with the word, "doubt." The time has come to think and to doubt the usual excuses.

Subscribe to:

Comments (Atom)