(Click on image to enlarge)

Today, USDA released its monthly "Agricultural Prices" report and on page 26 the "All Milk Price" as a "percent of parity" is listed at 38%. The point of parity was to keep farm milk price rising, generally, at the inflation rate, so dairy farmers could "keep up" with others.

A while back I posted a graph which projected milk production beyond the elimination of parity. That graph indicated actual milk production increased as prices for milk fell. Nevertheless, many still think that dairy farmers were over producing at the time parity was eliminated.

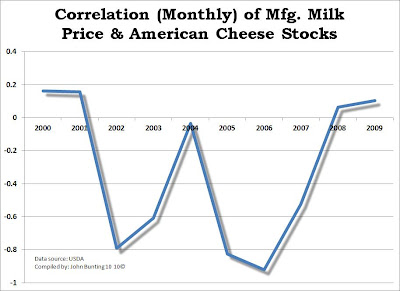

So, now in the graph above, is the actual data available to decision makers on production. This is not a case where the "truth" lies somewhere in the middle.

Retail prices of food have risen slightly more than inflation.

Those politicians who established parity were well acquainted with the hard times of the depression. That generation knew the result of corporate greed.