Dairy Product Prices: http://usda.mannlib.cornell.edu/usda/current/DairProdPr/DairProdPr-12-30-2010.pdf

All prices, except for whey, fell - what a way to end the year.

We are exporting bunches, including milk powder. The is no NFDM to be had in the country and yet: "Grade A standards averaged $1.14 per pound for the week ending December 25, 2010. The US price per pound decreased 7.5 cents from the previous week."

The shenanigans continue.

Well, here's wishing for a much better New Year for all.

Friday, December 31, 2010

Thursday, December 30, 2010

Corn COT

(Click on image to enlarge)

Corn prices fell today. What next. If the CFTC's Commitment of Traders (COT) report carries any meaning, on the commercial side there are a lot of shorts. That should mean prices should continue to drop.. We'll see.

Wednesday, December 29, 2010

Eating Habits and Employment

A new paper is out on from the National bureau of Economic Research (NBER)

HOW DOES THE BUSINESS CYCLE AFFECT EATING HABITS?

Dhaval M. Dave

Inas Rashad Kelly

Working Paper 16638

http://www.nber.org/papers/w16638

Essentially, the authors have found:

Looking through the data indicates less milk is consumed. So, perhaps the decline in milk consumption is associated with lack of jobs - logical.

According to the BLS:

HOW DOES THE BUSINESS CYCLE AFFECT EATING HABITS?

Dhaval M. Dave

Inas Rashad Kelly

Working Paper 16638

http://www.nber.org/papers/w16638

Essentially, the authors have found:

"Estimates, based on fixed effects methodologies, indicate that a higher risk of unemployment is associated with reduced consumption of fruits and vegetables and increased consumption of “unhealthy” foods such as snacks and fast food."

Looking through the data indicates less milk is consumed. So, perhaps the decline in milk consumption is associated with lack of jobs - logical.

According to the BLS:

In November employers took 1,586 mass layoff actions involving 152,816 workers. Layoff events decreased by 65 from the prior month, while initial claims increased by 4,757. Manufacturing accounted for 354 events, resulting in 39,465 initial claims.

Tuesday, December 28, 2010

2011

Today prices fell again on the CME for cheese. The big picture is quite different:

http://www.ap-foodtechnology.com/Industry-drivers/Dairy-market-to-remain-tight-in-2011-says-Rabobank

The global dairy market is likely to “remain tight” in 2011, due to an improvement in demand but limited supply, according to Rabobank.

The bank said in its Global Dairy Outlook report that although consumption rates are set to be strong in the new year, growth in some regions will be constrained by physical limitations of supply.

“Drought in Russia and floods in Pakistan will heavily impact local milk production in the first half of 2011”, said Rabobank.

While these conditions are likely to create increased demand for imports, the bank said that domestic consumption is likely to be restricted.

Consumption is expected to be supported by improving labour markets in the West, strong economic growth in import regions and strong buying in China.

Supply levels

Factors effecting supply levels include higher feed costs, ongoing requirements for farmers to reduce debt levels and the likelihood of limited supply growth beyond New Zealand.

Given the country’s central role in determining Southern Hemisphere surpluses this season, any adverse weather events through the 2010/11 season could have an upside effect on dairy prices in 2011, said Rabobank.

An increase in grain prices could also “dampen” milk production volumes and consequently lead to an increase in dairy prices, said the bank.

According to reports on Rabobank’s latest quarterly statement, international dairy commodity prices drifted higher through Q4 2010, building on already high levels.

Rabobank had previously predicted high price levels for 2011 if prices held firm in Q4 2010. However, the bank said alternative scenarios should also be considered.

Future role of China and India

Rabobank has also changed its view on the likely role of China and India in global dairy markets.

The bank has abandoned the view that the countries will reach self-sufficiency soon and now predicts that they will call on the world market more frequently in the next three to four years.

Rabobank said that China in particular has a structural deficit that will be difficult to erode in coming years.

http://www.ap-foodtechnology.com/Industry-drivers/Dairy-market-to-remain-tight-in-2011-says-Rabobank

Monday, December 27, 2010

Corn & Soy

Today, corn futures for July 2011 rose to 628 cents per bushel. soy bean for May 2011 rose to 1396.6 cents per bushel.

Who really knows who owns the land those crops are harvested form, but farmland price are booming:

more at: http://napervillesun.suntimes.com/business/3039967-420/farmland-prices-percent-farmers-commodity.html

Dairy farmers turn is right around the corner - or something like that.

Who really knows who owns the land those crops are harvested form, but farmland price are booming:

DES MOINES, Iowa (AP) — Increased commodity prices and strong demand have sent prices of farmland skyrocketing, making it more difficult for young and beginning farmers to get established but strengthening the balance sheets for those who own the land.

Across the Corn Belt, the price of farmland was on the rise in 2010. The highest increases were seen in Iowa, where values rose 13 percent and an acre of farmland sold for upward of $7,000 in some areas of the state. Minnesota and Wisconsin also saw double digit increases in farmland value, averaging 12 percent and 11 percent respectively, according to the Federal Reserve Bank in Kansas City.

more at: http://napervillesun.suntimes.com/business/3039967-420/farmland-prices-percent-farmers-commodity.html

Dairy farmers turn is right around the corner - or something like that.

Sunday, December 26, 2010

Friends and Allies

New Zealand's near-monopoly co-op Fonterra has had partnerships with DFA, DairyAmerica, and now CDI. The deal with CDI is to make a "cheese."

This past week a new patent was issued to Fonterra by the U. S. Patent and trade Office (USPTO. the patent begins:

United States Patent 7,854,952

Carr , et al. December 21, 2010

Process for preparing concentrated milk protein ingredient and processed cheese made therefrom

Abstract

Very interesting. Who will benefit from this?

This past week a new patent was issued to Fonterra by the U. S. Patent and trade Office (USPTO. the patent begins:

United States Patent 7,854,952

Carr , et al. December 21, 2010

Process for preparing concentrated milk protein ingredient and processed cheese made therefrom

Abstract

Process for preparing a concentrated milk protein ingredient comprising the steps of: providing a membrane retentate solution having kappa-casein milk protein, adjusting the divalent ion content of said protein solution to a predetermined level at which no gel is formed after treatment with milk clotting enzyme, adding a food grade milk clotting enzyme under conditions where kappa-casein is converted to para-kappa casein while remaining in solution, terminating the conversion by removal or inactivation of the enzyme and concentrating said solution. The resultant milk protein concentrate ingredient is used in the production of cheese.

Very interesting. Who will benefit from this?

Saturday, December 25, 2010

Jefferson Bible

Thomas Jefferson was not only a great president but also, an outstanding scholar. His interest in philosophy and morals led him to assemble: "The Life and Morals of Jesus of Nazareth Extracted Textually from the Gospels", more commonly known as the Jefferson Bible.

Jefferson's Bible was given to every entering member of Congress for more than half of the 20th century.

So, on the day we observe the birth of Christ: http://www.angelfire.com/co/JeffersonBible/

I hope everyone has had a good Christmas.

Jefferson's Bible was given to every entering member of Congress for more than half of the 20th century.

So, on the day we observe the birth of Christ: http://www.angelfire.com/co/JeffersonBible/

I hope everyone has had a good Christmas.

Friday, December 24, 2010

Christmas Eve

Adam smith is the so-called father of capitalism. Smith wrote another book which many, including Smith felt to be more important. The book is: "The Theory of Moral Sentiments."

Many of his thoughts seem appropriate of the season:

http://www.econlib.org/library/Smith/smMS.html

Merry Christmas Eve.

Many of his thoughts seem appropriate of the season:

How selfish soever man may be supposed, there are evidently some principles in his nature, which interest him in the fortunes of others, and render their happiness necessary to him, though he derives nothing from it, except the pleasure of seeing it. Of this kind is pity or compassion, the emotion we feel for the misery of others, when we either see it, or are made to conceive it in a very lively manner. That we often derive sorrow from the sorrows of others, is a matter of fact too obvious to require any instances to prove it; for this sentiment, like all the other original passions of human nature, is by no means confined to the virtuous or the humane, though they perhaps may feel it with the most exquisite sensibility. The greatest ruffian, the most hardened violator of the laws of society, is not altogether without it.

http://www.econlib.org/library/Smith/smMS.html

Merry Christmas Eve.

Thursday, December 23, 2010

DIAC

http://www.idfa.org/news--views/details/5488/

IDFA may seem worried but,as IDFA knows, the status quo will prevail.

Dairy Advisory Committee Votes for Supply Control, Higher Milk Solids

Meeting this week in Washington, D.C., the Dairy Industry Advisory Committee established by Agriculture Secretary Tom Vilsack came closer to finalizing its recommendations for improving profitability for dairy producers and reducing farm-milk price volatility. The major action occurred on Thursday when the committee voted on and accepted approximately 20 recommendations for policy changes.

While most of the proposals represent good steps forward for the industry, the committee also passed by a one-vote margin a recommendation that all states be mandated to adopt California's standards for milk solids and, by a similar one-vote margin, a proposal to implement a government-mandated "growth management program." IDFA is opposed to both of these recommendations.

"The committee has worked to examine price volatility and dairy farmer profitability and has reached broad consensus with support from both processors and producers on the need for new policies and programs to help the industry," said Jerry Slominski, IDFA senior vice president. "But these two highly controversial and extremely close votes in support of policies that have negative track records divide the industry and threaten the good work that has been done to date."

The committee is expected to meet one more time, on January 12-13, to finalize the recommendations and send them to Secretary Vilsack for review.

Regarding a requirement for higher milk solids, IDFA believes implementing California's standards throughout the country would raise retail milk prices, increase the costs of federal nutrition programs and reduce dairy exports. It also could hurt consumption and would increase the calories per serving of milk.

IDFA also holds that government-mandated limits on milk production are short-sighted and counter-productive. A recent study by Informa Economics, sponsored by IDFA, examined what happened in Canada, the European Union and other countries when government-mandated supply controls were implemented and enforced. The study concluded that supply-control programs limit exports, create an economic incentive for imports and increase consumer milk and milk-product prices.

"On the positive side, we are encouraged by the committee's proposals to endorse a new revenue-insurance program and to further review the Federal Milk Marketing Order system," Slominski said.

More details will be available soon on the Dairy Industry Advisory Committee section of the U.S. Department of Agriculture website.

IDFA may seem worried but,as IDFA knows, the status quo will prevail.

Wednesday, December 22, 2010

Looking Good

New Zealand's ASB bank today stated:

So there you have it. Our fault.

Dairy prices continued to fluctuate through the early stages of 2010 but, since rebounding in early September, they have been largely stable. Stabilising prices have been good news for the market and also for NZ dairy farmers in terms of Fonterra payout. We are positive about the outlook for dairy in 2011. However, some pressure may come on prices if supply growth continues in the main producing nations in the Northern Hemisphere. The latest example is US milk production lifting 2.7% in November compared to a year earlier.

So there you have it. Our fault.

Tuesday, December 21, 2010

More Consolidation?

http://www.bloomberg.com/news/2010-12-12/a-p-grocery-store-owner-files-for-bankruptcy-as-competition-heightens.html

Supermarkets wear the pants in the dairy business. Consolidation has increased steadily since the early 80s.

Now we find from the above link:

A&P, Century-Old U.S. Grocery Store Owner, Files for Bankruptcy

Further consolidation will not serve the public's interest.

Supermarkets wear the pants in the dairy business. Consolidation has increased steadily since the early 80s.

Now we find from the above link:

A&P, Century-Old U.S. Grocery Store Owner, Files for Bankruptcy

Great Atlantic & Pacific Tea Co., operator of almost 400 supermarkets under names including Waldbaum’s, Food Emporium and Pathmark, filed for bankruptcy after failing to compete with wholesale clubs and drugstores.

Further consolidation will not serve the public's interest.

Monday, December 20, 2010

Consumer Spending

(click on images to enlarge)

The Bureau of Economic Analysis (BEA) regularly publishes data on consumer spending called "Personal Consumption Expenditures" (PCE). The monthly data for "processed dairy products" shows a clear increase in consumer spending through October 2010. So, what can explain the fall in farm milk price generated by players on the CME. I would suggest someone in a position to do so look at the "shorts" on the class III futures.

Sunday, December 19, 2010

Consequencences

Last Tuesday the IBA representative came and dropped off a calendar. a few yeqars ago IBA changed from calendars which had "old" farm pictures to recent "farm" pictures. Many of the recent photos look more like a second home than a farm. However, to me, the real difference is that the old pictures always were filled with people.

On October 3, 2010 Philippa Foot died. She created what is known a s the "Trolley Problem": http://en.wikipedia.org/wiki/Trolley_problem#Overview

In the original problem, which Foot developed, a runaway trolley in heading toward four workers on the track. If you through a switch, the four will be saved but one man working on the spur will die. Do you throw the switch? Most would.

A variation was developed by Judith Thompson. There is no switch but, the trolley can be stopped by throwing a heavy object off the bridge from where the observer is standing. The only heavy object is a fat man - big enough to stop the trolley - he would be killed. Most people would not throw the fat man. The numbers are the same, one death saves several lives.

These are ethical problems. Change the problem to economics, dairy economics, and everything about ethics goes out the door.

Several dairies fall and one is left standing. This is all done in the name of efficiency. However, is there a benefit to society? Depopulating rural America is not in anyone's long-term interest.

I suspect the divorce of ethics from economics is primarily in the manner in which the problem is stated.

On October 3, 2010 Philippa Foot died. She created what is known a s the "Trolley Problem": http://en.wikipedia.org/wiki/Trolley_problem#Overview

In the original problem, which Foot developed, a runaway trolley in heading toward four workers on the track. If you through a switch, the four will be saved but one man working on the spur will die. Do you throw the switch? Most would.

A variation was developed by Judith Thompson. There is no switch but, the trolley can be stopped by throwing a heavy object off the bridge from where the observer is standing. The only heavy object is a fat man - big enough to stop the trolley - he would be killed. Most people would not throw the fat man. The numbers are the same, one death saves several lives.

These are ethical problems. Change the problem to economics, dairy economics, and everything about ethics goes out the door.

Several dairies fall and one is left standing. This is all done in the name of efficiency. However, is there a benefit to society? Depopulating rural America is not in anyone's long-term interest.

I suspect the divorce of ethics from economics is primarily in the manner in which the problem is stated.

Saturday, December 18, 2010

Political Tricks

This U.S. Congress is coming to an end. There will be no S.1645 for "everyone" to get behind. This bill has the same fate as all its predecessors, S889 and S.1720. This time, however, there will be no Senator Specter to "sponsor" a new bill.

What were the odds of any (S889, S 1720 and S1645) passing. Totally disregarding merits, there is a 3% chance of any bill becoming law.

Some states have similar problems. In an article "Albany Handshake":

This is not to say, nothing can be done but, the chances of new legislation are pretty slim.

What were the odds of any (S889, S 1720 and S1645) passing. Totally disregarding merits, there is a 3% chance of any bill becoming law.

Some states have similar problems. In an article "Albany Handshake":

This surfeit of hopeless legislation clogs the

system: New York State lawmakers during

2008 proposed a record 18,000

bills—7,000 more than the U.S. Congress

and more than any other state

legislature. Only 9 percent passed. The

laziness, the corruption, the shameless

posturing, the unchecked power of the

leadership—that’s the deal in Albany;

that’s the handshake.

This is not to say, nothing can be done but, the chances of new legislation are pretty slim.

Friday, December 17, 2010

November Milk Production

(click on image to enlarge)

Today USDA released its "Milk Production" report. The report showed, surprise, surprise, that milk production was up in November 2010 by over 3%. The numbers can be argued until the cows come home. The numbers are not a precise measurement. Exact numbers are very difficult to come by.

There are some, many quite a few, who think all we need is supply management and the farm milk price will rise magically. First off, if the numbers are not precise, how can the supply be managed?

Perhaps more importantly, there is a genuine need for a small surplus. Milk supply varies day-to-day. But, the consumer expects to find the dairy product on the shelf. To insure the consumer is always supplied requires extra production.

The real problem is not the small "surplus," the real problem is the small surplus is the excuse to undercut dairy farm milk prices.

Essentially, the problem is a moral problem.

Thursday, December 16, 2010

New Rating

http://www.tradingmarkets.com/news/stock-alert/df_fitch-rates-dean-s-proposed-400mm-issuance-ccc/rr6--1368466.html

This is what it means to be "King of the Mountain."

Fitch Rates Dean's Proposed $400MM Issuance 'CCC/RR6'

Posted on: Wed, 15 Dec 2010 01:08:50 EST

Symbols: DF

Dec 15, 2010 (Close-Up Media via COMTEX) --

Fitch Ratings has assigned a 'CCC/RR6' rating to Dean Foods Company's (Dean; NYSE

: DF | PowerRating) approximately $400 million proposed senior unsecured notes. The ratings remain on Rating Watch Negative.

Today Dean announced preliminary plans to offer, subject to market and other conditions, up to approximately $400 million of senior notes. The company also entered into an amendment to its bank credit and receivables purchase agreements, dated April 2, 2007 and subsequently amended and restated on June 30. The amendments are conditioned upon the completion of the notes offering and subsequent debt paydown as described below.

Dean intends to use net proceeds from the debt offering to pay down a portion of its outstanding bank term loan A and to pay fees and expenses related to the credit facility amendment mentioned above. At Sept. 30, Dean had $4.1 billion of total debt, of which approximately $1.3 billion was related to its term A loan. Roughly $1.1 billion of this term loan matures on April 2, 2014.

Fitch's 'CCC/RR6' rating is based on expectations that the newly issued notes will rank pari passu with Dean's existing senior unsecured notes. The company's existing $500 million of 7 percent guaranteed notes due June 1, 2016 contain a change of control provision that requires Dean, or any third party involved in a change of control, to repurchase all or any part of the notes at a purchase price of 101 percent plus accrued and unpaid interest.

Furthermore, due to Fitch's recovery analysis, which incorporates a notching methodology relative to the Issuer Default Rating (IDR), the 'CCC/RR6' rating implies limited recovery in a distressed situation. Fitch does not expect Dean to default on these obligations; however, the unsecured note rating reflects the heavy mix of secured debt in the company's capital structure and Fitch's view that limited value would be available for distribution to unsecured bondholders if there were a recovery event.

On Dec. 3, Fitch downgraded Dean's IDR to 'B' from 'B+' due to materially higher than expected declines in operating earnings and cash flow along with Fitch's expectation that financial leverage will remain elevated through 2011. Additionally, Fitch placed all of Dean's ratings on Rating Watch Negative because of heightened covenant risk under the company's secured bank facility's maximum leverage requirement. The amendment to Dean's credit facility provides increased flexibility under its maximum leverage ratio and minimum interest coverage requirements while introducing a new senior secured leverage ratio condition.

From the effective date of the amendment through Dec. 31, 2011, Dean's maximum leverage ratio will be 5.75 times (x), stepping down by 0.25x increments annually at Dec. 31 until Sept. 30, 2013 when the ratio falls to 4.5x. The company's minimum interest coverage ratio is set at 2.5x through Dec. 31, 2011, stepping up to 2.75x at March 31, 2012 and then increasing to 3.0x at March 31, 2013. Dean's new maximum senior secured leverage ratio is 4.25x through Dec. 31, 2011, declining to 3.75x on March 31, 2012 and then to 3.5x on March 31, 2013.

Fitch currently projects that total debt-to-operating EBITDA for Dean will approximate 5.6x at year end 2010 and 5.4x at the end of 2011. Given that the company's bank covenants excludes up to $100 million of unrestricted cash and adjusts for non-cash expenses and non-recurring charges, Fitch expects cushion under Dean's covenants to gradually improve as operating performance stabilizes and the company uses free cash flow along with proceeds from potential asset sales to repay debt.

Negative Rating Watch and Rating Triggers:

Fitch views the amendment to Dean's credit and receivables-backed facilities positively and currently believes the company's liquidity is adequate. At Sept. 30, Dean had $1.5 billion of liquidity which included $102.1 million of cash, $863.1 million of revolver availability and $481.3 million of borrowing capacity under its receivables-backed facility. Of the secured revolver, $225 million expires on April 2, 2012 while $1.3 billion is due April 2, 2014. Once the amendment becomes effective, the maturity date on the company's $600 million receivables-backed facility will be Sept. 30, 2011 versus June 30, 2011 currently.

Dean's ratings will be removed from Negative Watch once the amendment of the company's credit facility becomes effective. As previously mentioned, effectiveness is conditioned upon Dean issuing up to $400 million of the aforementioned rated notes (which must be at least seven years in tenure) on or before Feb. 28, 2011 and using net proceeds to prepay its term A loan as outlined by the agreement.

Fitch currently rates Dean and its wholly-owned subsidiary Dean Holding Company as follows:

Dean Foods Company (Parent)

--Issuer Default Rating (IDR) 'B';

--Bank credit facility 'BB-/RR2';

--Senior unsecured debt 'CCC/RR6'.

Dean Holding Company (Operating Subsidiary)

--IDR 'B';

--Senior unsecured debt 'CCC/RR6'.

This is what it means to be "King of the Mountain."

Wednesday, December 15, 2010

Cheddar Prices

(click on image to enlarge)

We do live in interesting times. Today, the Bureau of Labor Statistics (BLS) released Consumer Price data through November 2010. Retail price of Cheddar cheese rose in November 2010 while the Cheddar price on the CME fell. The CME Cheddar price determines both wholesale cheese prices and dairy farm milk price.

In November, the spread between CME and retail was $3.54.

Meanwhile on the CME the second highest amount of cheese was traded - a total of 45 loads. All trades were based on bids. Five players placed bids. Jacoby bought the most. All loads were sold by Jerome.

If all these players needed cheese why did the price not go up? The price fell by 1 1/4 cents to $1.3225. One also would have to assume Jacoby could not find Jerome's number so the cheese could be bought off the exchange without having to pay the CME fee.

Fonterra's GlobalDairy Trade auction prices all rose today. There are serious concerns about the global dairy supply.

Dairy Market News lists Oceania Cheddar (Dec 9, 2010) at $1.905, which is the world price.

Tuesday, December 14, 2010

Which Way

(click on image to enlarge)

Today, December 14, 2010 CME block prices fell again to $1.3350 per pound. USDA released its latest World Agricultural Supply and Demand Estimate (WASDE). The dairy page is above.

There is a serious disconnect between the activity on the CME and WASDE report. January's class III futures on the CME settled at $13.11.

There is a serious disconnect between CME block prices and other prices on the CME. NFDM Grade A $1.27 per pound.

Monday, December 13, 2010

Eye of the Beholder

(click on image to enlarge)

A commenter complained on Saturday's post that I had not taken ethanol subsidies to task. Ethanol certainly has driven up dairy farm feed costs, adding to other dairy farm concerns.

We truly need fair market prices for all farm products - not subsidies. But, dairy farmers have benefited from subsidies to grain farmers. As can be seen from the graph above corn farmers have lost money most every year. There would be no corn for dairy farmers without subsidies.

Many U.S. dairy farmers feel the Canadian farm milk pricing system is not market oriented. However, a recent study from Canada by, Peter Clark, president of Grey, Clark, Shih and Associates Limited. found U.S. dairy farmers are heavily subsidized. The study, according to a press release found, "U.S. federal, state and local governments continue to subsidize their agriculture industries with a labyrinth of programs that are conservatively estimated at over US$180 billion in 2009 and representing well more than half of total U.S. farm gate revenues of US$290 billion."

The release stated, "In summary, the subsidies to U.S. dairy producers are essentially equivalent to revenue the industry receives from the market place. This generous support enables U.S. producers to sell below their fully absorbed cost of production by insulating them from the need to earn a profit from the market. The support also permits insulation from international price pressures."

The selling price for a product, according to the dictates of capitalism, is costs plus profit equals selling price. The CME trading flies in the face of capitalism.

Sunday, December 12, 2010

Butter Prices

(click on image to enlarge)

The above graph tells a couple stories. First, butter exports are doing nothing to boost U.S. dairy farm milk prices.

http://www.usdec.org/home.cfm?navItemNumber=82205

"USDEC is funded primarily by the dairy promotion check-off program. It also receives export activity support from the U.S. Department of Agriculture's Foreign Agricultural Service (FAS). Membership dues fund the trade policy and lobbying activities of the Council."

Secondly, you will note Hoogwegt is a member of USDEC and is the main player on the CME driving down butter prices.

So who is watching the store?

Saturday, December 11, 2010

Best Dairy State oh Boy Youbetcha

In America the leading policy formulators for dairy ascribe a certain omniscience to the "market." Omniscience is the property of having complete or maximal knowledge.

Well, it would seem that a certain buyer of milk, who makes Cheddar, thinks (is certain) its suppliers can make milk with block Cheddar on the CME at $1.39. Most anyone who cares to know, knows there is a near perfect correlation between CME block prices and dairy farm milk price.

So, if you put it all together, you must conclude Idaho is the best state to have a dairy operation - and that Washington D.C. is the best place to take a nap.

Well, it would seem that a certain buyer of milk, who makes Cheddar, thinks (is certain) its suppliers can make milk with block Cheddar on the CME at $1.39. Most anyone who cares to know, knows there is a near perfect correlation between CME block prices and dairy farm milk price.

So, if you put it all together, you must conclude Idaho is the best state to have a dairy operation - and that Washington D.C. is the best place to take a nap.

Friday, December 10, 2010

Dean Foods Bonds

(click on image to enlarge)

Dean stocks rose significantly today, mostly on news regarding bonds. The bond interest rate is more than twice the 30 year mortgage rate.

A Bloomberg report: http://www.bloomberg.com/news/2010-12-09/dean-foods-chief-engels-loses-59-as-s-p-s-worst-after-milk-takeovers-sour.html

"Credit Suisse Group AG analyst Robert Moskow says Dean’s strategy of driving down costs to undercut smaller, less efficient milk processors and force them to scale back capacity hasn’t yielded results. At the same time, Dean is facing pressure from retailers who are discounting milk to attract penny-pinching consumers while demanding price breaks from suppliers. Also, more shoppers are buying cheaper private label milk products instead of Dean’s brands."

So, here we are with dairy farmers near the bottom and the largest fluid in terrible financial shape.

Thursday, December 9, 2010

Dean Settles

In an 8K SEC document filed today Dean stated:

Well, we'll see. At this point DFA and DMS (one and the same) have not settled and the case moves ahead with "discovery" extended to April 15, 2011.

The Company has reached an agreement with the plaintiffs in its previously disclosed purported class action antitrust lawsuit filed in the United States District Court for the District of Vermont to settle all claims against the Company in such action. The settlement agreement is subject to court approval. There can be no assurance that the court will approve the agreement as proposed by the parties. Pursuant to the agreement, the Company would be obligated to pay $30 million, and would agree to other terms and conditions with respect to its raw milk procurement activities at certain of its processing plants located in the Northeast. The Company expects to take a charge in the fourth quarter of 2010 of approximately $18.4 million, net of tax, with respect to the proposed settlement.

Well, we'll see. At this point DFA and DMS (one and the same) have not settled and the case moves ahead with "discovery" extended to April 15, 2011.

Wednesday, December 8, 2010

Numbers

(click on image to enlarge)

The numbers used to justify changes in farm milk price are not precise measurements. A look at the above graph is interesting. Nationally, there is one cow herd. If a farm had the variations seen above, the owner would know there is a problem.

Tuesday, December 7, 2010

Retail Milk Prices

The Bureau of Labor Statistics (BLS) regularly publishes extensive data. Among the data available is the retail price of milk. For June 2010 the BLS lists the retail price in the average U.S. city as $3.30 per gallon for whole milk.

The Australian Bureau of Agricultural and Resource Economics (ABARE)publishes extensive dairy data. ABARE lists the retail price for a gallon of milk (converted from liters to U.S. gallons) in Australia for June 2010 as $6.92.

The point is there is no relationship between farm milk price and the price consumers pay.

The Australian Bureau of Agricultural and Resource Economics (ABARE)publishes extensive dairy data. ABARE lists the retail price for a gallon of milk (converted from liters to U.S. gallons) in Australia for June 2010 as $6.92.

The point is there is no relationship between farm milk price and the price consumers pay.

Monday, December 6, 2010

New Zealand & U.S. Dairy Farm Milk Price

(click on image to enlarge)

In the above graph I took some liberties. The New Zealand production year starts in the middle of the calendar year. Therefore, some time adjustment is needed. Next, by placing the NZ price on the right axis, I was surprised to note that the two prices, visually, can be compared.

Recently, the price NZ farms receive has become higher than the U.S. price. Both the U.S. and NZ prices have been rising but, note the trends. NZ farm milk prices have been rising at a faster rate.

All the conventional experts talk about a world market. Exports are very, very important everyone is told. Well, if U.S. prices are lower than world prices, exports are very, very important to someone but, not dairy farmers.

Sunday, December 5, 2010

External Capital

(click on image to enlarge)

Conventional thinking, like the carnival worker, wants attention focused on supply/demand as the sole driver of production - simple answers are always favored.

We will soon hear some reports from the Dairy Industry Advisory Committee (DIAC) and the combined DOJ/USDA hearing. One could almost guarantee, there will be no mention of external capital driving production. That is capital not derived from the business of dairy farming.

In 2003 Rural Sociology magazine published a paper "Dairy Industrialization in the First Place" The article was all about the importance of L.A. real estate values driving dairy production.

Then in 2006 McKinsey & Company published a report ($2.3 million price tag) for the California Milk Advisory Board titled, "Foundations for a Consumer-Driven Dairy Growth Strategy" which stated, "The industry also benefited from a vitalizing cycle of reinvestments, spurred by steadily appreciating land values, useful capital gains tax treatment, and cash accounting."

So, even though there are dairies all over the country, growth has been driven primarily in the West funded with "appreciating land values" mostly from L.A. There is a .61 (positive) correlation between L.A. real estate values and the number of cows on farms in the U.S. As can be seen in the above graph, there is a lag factor.

The likelihood of real estate gaining legs and walking again is pretty remote. Unemployment is serious. Beneath the normally reported unemployment data are some very gruesome details. The employment participation rate for men age 25 to 54 (prime working years)fell in November to a record 88.8%. Without jobs there can be no buying of homes.

Capitalism holds that the selling price of anything is costs plus profit. The "real" profit generates capital. How long has it been since dairy has generated capital? How long has it been that policy makers have attributed growth in milk production to the wrong factor?

Saturday, December 4, 2010

The Failure of Conventional Thinking

(click on image to enlarge)

A few post ago, I cited an article which mentioned a milk glut because of high farm milk prices a couple years ago. I said some, not all farmers expanded.

However, the real economic measure is not high milk price for a few months, but rather, profitability. Many dairy economist have used milk/feed ratio as a measure of profit. Some have even mentioned that expansion is only likely when the ratio is over three.

A look at the above graph shows there is no relationship between expansion (number of cows) and the milk feed ratio. The trend for the ratio is down and yet the cow numbers have grown. The statistical correlation between the two sets of data should be positive - the higher the milk feed ratio, the higher the number of cows should be. Instead, the statistical correlation is -.61.

Clearly, there is something else at work with expansion. If policy makers and the public media do not understand the total picture, how sound can any dairy policy be?

Friday, December 3, 2010

Butter Moving Up

The latest Dairy Market News states:

At the CME butter went up 5 1/4 cents yesterday December 2, 2010. Today, butter went up 21/2 cents. Interestingly, Daisy Brand has been active on the selling side. Daisy Brand does not make butter.

DECEMBER 3, 2010 MADISON, WI (REPORT 48)

BUTTER HIGHLIGHTS: The CME Group AA cash butter price

declined early in the week but recovered late to close at

$1.6100 (-6 cents from last Wednesday, November 24 close).

Churning was more active over the long holiday weekend while

many other cream users were closed. Printing continues to

fill last minute orders from bulk and fresh stocks. Export

interest has improved with the lower prices. Some

manufacturers are looking at increasing butter/butterfat

exports, particularly during the yearend holiday season.

The "new crop" butter production year started December 1,

allowing CME Group cash butter market sale eligibility until

March 1, 2012.

At the CME butter went up 5 1/4 cents yesterday December 2, 2010. Today, butter went up 21/2 cents. Interestingly, Daisy Brand has been active on the selling side. Daisy Brand does not make butter.

Thursday, December 2, 2010

Dairy Products

(click on image to enlarge)

Today USDA NASS released its "Dairy Products" report, which is available at: http://usda.mannlib.cornell.edu/usda/current/DairProd/DairProd-12-02-2010.pdf

Total cheese was up 3.5%. Whey is a by-product of cheesemaking. If cheese production increases whey production should increase proportionately. However,as can be seen above, whey production was down. What is going on?

Notice though, lactose production was way up. Traditionally, lactose was part of whey and taken from whey. But, ultrafiltration of milk which is used to bump up cheese yield. Lactose is a by product of ultrafiltration.

Not only is imported MPCs bumping up cheese yield , but also, ultrafiltration is contributing to cheese stocks.

As with MPCs, ultrafiltration produces an inferior product. Whey, minus the lactose is retained in the Ultrafiltered milk. Hence less whey.

Wednesday, December 1, 2010

Commercial Disappearances

(click on image to enlarge)

If there is any meaning to the word "glut", that meaning cannot be found in the data. As can be seen above, "Commercial Disappearances" as reported by USDA exceed the farm "marketings." Through September 2010, the Commercial Disappearances have been 1.4 billion pounds more (milk equivalent) than farm marketings.

Tuesday, November 30, 2010

Trading

Today on the CME there was no movement on butter. Hoogwegt has been, for all practical purposes, the sole player in moving butter down by way of offers. Butter has fallen over 45 cents in the past seven days. Does Hoogwegt make butter? No. Is there too much butter? No. Is this the market at work? No.

On what might be considered a more positive note, Kraft has been an active player in moving the price of barrels higher. Wonders never cease.

On what might be considered a more positive note, Kraft has been an active player in moving the price of barrels higher. Wonders never cease.

Monday, November 29, 2010

Glut

(click on image to enlarge)

Here is another article I find disturbing: http://www.bloomberg.com/news/2010-11-29/milk-glut-ruins-u-s-dairy-farm-profits-as-48-corn-rally-boosts-feed-cost.html

The article states: "Dairy farmers expanded herds following the 70 percent jump in prices to a record in 2007, just before the U.S. began its longest recession since before World War II and unemployment rose to the highest level in a quarter century." Did all dairy farmers expand herds in 2007? No. Could a competent rural sociologist shed some light on who did and who did not expand production?

Furthermore, As the above graph plainly shows, milk production had been climbing fairly steadily for several years, including years of low milk price.

Sunday, November 28, 2010

Wisconsin Survey

At: http://www.nass.usda.gov/Statistics_by_State/Wisconsin/Publications/Dairy/Dairy_OP_Release_10.pdf

is a very recent survey of dairy operations in Wisconsin.

Some of the information is broken down by farm size.

This reminds me of a game theory called "Prisoners Dilemma"

http://en.wikipedia.org/wiki/Prisoner%27s_dilemma

"The prisoner's dilemma is a fundamental problem in game theory that demonstrates why two people might not cooperate even if it is in both their best interests to do so."

As the "prisoners dilemma" is generally discussed, only the actions of the players are mentioned. There are however, external forces to the players. What should be the role of the state or federal governments in fostering cooperation? Oh no! That would never do. We need competition. Those who advocate this always think some unknown person will lose. It is never a close friend or relative.

is a very recent survey of dairy operations in Wisconsin.

Some of the information is broken down by farm size.

This reminds me of a game theory called "Prisoners Dilemma"

http://en.wikipedia.org/wiki/Prisoner%27s_dilemma

"The prisoner's dilemma is a fundamental problem in game theory that demonstrates why two people might not cooperate even if it is in both their best interests to do so."

As the "prisoners dilemma" is generally discussed, only the actions of the players are mentioned. There are however, external forces to the players. What should be the role of the state or federal governments in fostering cooperation? Oh no! That would never do. We need competition. Those who advocate this always think some unknown person will lose. It is never a close friend or relative.

Saturday, November 27, 2010

FAO Outlook

The Food and Agricultural Organization of the UN has recently release its world food out report. The report is avail at: http://www.fao.org/docrep/013/al969e/al969e00.pdf

This is a big file and takes some time to download.

Dairy begins on page 51 with:

With prices "firm" who needs risk management? However, those are world prices

This is a big file and takes some time to download.

Dairy begins on page 51 with:

The monthly FAO price index of international dairy products,

which consists of a basket of export prices in Oceania for

whole milk powder (WMP), butter, skim milk powder (SMP)

and cheese, has remained firm so far in 2010, in contrast

with the significant swings observed in the past two years.

The FAO index was 198 in September 2010, similar to its

level in January 2010 but 38 percent higher than the average

for 2009. While this represents a strong recovery from

last year, it still remains 20 percent below its peak value in

early 2008. However, compared with the base period of

2002–04, prices have doubled. Export prices in Oceania in

September 2010 were USD/tonne 4 100 for butter, 3 140 for

SMP, 3 360 for WMP and 3 950 for cheese.

With prices "firm" who needs risk management? However, those are world prices

Friday, November 26, 2010

China's Food Crisis

Exports of U.S. dairy products are way up. china has increased imports to dairy products from the U.S. by nearly 48%. This has not really helped the U.S. dairy farmers financially. Meanwhile, much of the rise in feed costs can be attributed to corn and soy exports to China.

China has some worries: http://blogs.wsj.com/chinarealtime/2010/11/26/china%E2%80%99s-inflationary-food-fight/

There have been riots, small riots in China over food prices. The Chinese government can always call out the army but, the stability of the government depends upon the people prospering. Things look worrisome.

When the world financial crisis hit, the American dairy farmer took a hit. This was because, those in power could take it out of the farmers hide. Meanwhile, there has been no change in dairy pricing policy. As the clock ticks, what looks like the future is NMPF plan to essentially maintain the status quo. Too bad!

China has some worries: http://blogs.wsj.com/chinarealtime/2010/11/26/china%E2%80%99s-inflationary-food-fight/

There have been riots, small riots in China over food prices. The Chinese government can always call out the army but, the stability of the government depends upon the people prospering. Things look worrisome.

When the world financial crisis hit, the American dairy farmer took a hit. This was because, those in power could take it out of the farmers hide. Meanwhile, there has been no change in dairy pricing policy. As the clock ticks, what looks like the future is NMPF plan to essentially maintain the status quo. Too bad!

Thursday, November 25, 2010

Thanksgiving Day

(click on image to enlarge)

Today is Thanksgiving day. In spite of the fact that is much to complain about, there is always something, usually many things, to be thankful for.

I personally, am very thankful for all those who take time to read this blog. The map above shows internet providers, not individual readers on a typical day reading this blog. Those who read the blog come from all walks. A law student told me she reads the blog everyday. USDA has its own IP and I can see that on many days USDA logs in over eleven hours.

So, I want to thank everyone and hope everyone has had a great Thanksgiving.

Wednesday, November 24, 2010

Real Names

There is an ancient saying, "The beginning of wisdom is to call things by their real names."

So: http://www.capitalpress.com/dairy/CRD-dairy-risks-w-art-112610

The article quotes Ed Gallagher, Dairy Farmers of America's vice president of economics and risk management.

Gallagher has the ability to know when butter has fallen $0.515 since the first of the month who did the dirty deed. DFA knows how easy it is to manipulate the CME - they got caught. DFA has not participated in the cash market since January 2009. CFTC has a person assigned to watch DFA at the CME. But, has DFA repented from their ways of leading farmers to think there is a real market?

So: http://www.capitalpress.com/dairy/CRD-dairy-risks-w-art-112610

The article quotes Ed Gallagher, Dairy Farmers of America's vice president of economics and risk management.

"We've got to do better yet," he said. "The market doesn't care what anybody's cost of production is. The long-run average price will just about equal long-run costs."

Margins keep tightening, and they're likely to tighten further.

Gallagher has the ability to know when butter has fallen $0.515 since the first of the month who did the dirty deed. DFA knows how easy it is to manipulate the CME - they got caught. DFA has not participated in the cash market since January 2009. CFTC has a person assigned to watch DFA at the CME. But, has DFA repented from their ways of leading farmers to think there is a real market?

Tuesday, November 23, 2010

Farming Systems

(click on image to enlarge)

In an early form of writing known as Runes, some experts claim the first word or symbol meant both wealth and cattle.

The above graph is from a report by the European Food Safety Authority titled "Scientific Report on the effects of farming systems on dairy cow welfare and disease."

A lot has changed. Dairy farming has become just another extractive industry, taking a toll on both man and beast.

Monday, November 22, 2010

Butter

(click on image to enlarge)

NASS released its "Cold Storage" report today:

http://www.usda.gov/nass/PUBS/TODAYRPT/cost1110.pdf

Cheese is up but then, so are the MPC imports - what's new.

But, butter "Butter stocks were down 17 percent from last month and down 43 percent from a year ago." Naturally, butter prices fell $0.09 per pound on one offer. No, the offer was not from a butter maker. Isn't the market system just swell?

http://www.hoogwegtus.com/

"Our Core Values:

We are serious about INTEGRITY . . ."

Sunday, November 21, 2010

Monetary Policy

One of the most important sets of data to follow is the U.S. Dollar Index. The U.S is in a bind. With high debt levels, the U.S. needs to export more products. When the Almighty Dollar was high, we imported a great deal. Monetary policy is a key factor driving the value of the dollar. Under Reagan, interest rates were driven up to slow inflation. As a matter of fact, that policy destroyed manufacturing in America.

So now, interest rates are in the basement, for those who can borrow, and the value of the dollar against other currecies has fallen dramatically.

China's currency is fixed. Essentially, this has created an artificially low exchange rate, which, as long as the U.S. Dollar was high, China's economy grew by leaps and bounds.

The Feds "quantitative easing" has lowed the value of the dollar which in turn impacts china's economy downward. Since, November 12, 2010 corn at the CBOT has lost 8% value. Soy at the CBOT has lost 10%.

Good for those who buy grain.

But, fertilizer imports (quantities)have risen 75% in the first nine months of this year and the prices are rising too. The same can be said of fuel.

While it is all well and good to talk about "risk Management", the total number of risk are unknown. Under those conditions, someone had better get a grip on the activity on the CME.

So now, interest rates are in the basement, for those who can borrow, and the value of the dollar against other currecies has fallen dramatically.

China's currency is fixed. Essentially, this has created an artificially low exchange rate, which, as long as the U.S. Dollar was high, China's economy grew by leaps and bounds.

The Feds "quantitative easing" has lowed the value of the dollar which in turn impacts china's economy downward. Since, November 12, 2010 corn at the CBOT has lost 8% value. Soy at the CBOT has lost 10%.

Good for those who buy grain.

But, fertilizer imports (quantities)have risen 75% in the first nine months of this year and the prices are rising too. The same can be said of fuel.

While it is all well and good to talk about "risk Management", the total number of risk are unknown. Under those conditions, someone had better get a grip on the activity on the CME.

Saturday, November 20, 2010

Legal Term of the Day

http://www.nolo.com/dictionary/adhesion-contract-(contract-of-adhesion)-term.html

adhesion contract (contract of adhesion)

In a very few situations dairy farmers have no contracts with their milk handler. In places where there is competition, the contract in often month-to-month. In the Northeast and elsewhere the contracts are for a year.

So, I suspect that many of the one year contracts are actual "adhesion contracts." The problem with adhesion contracts is the person on the bottom often (usually) has no resources to fight a case in court.

adhesion contract (contract of adhesion)

A contract that so strongly favors one party or so unfairly restricts another, that it creates a presumption that one party had no choice when entering into it. If a court determines that the contract is overly unfair, it may refuse to enforce the agreement against the disadvantaged party. An example of a contract of adhesion might be a form contract provided by an unethical leasing company. Adhesion contracts are often evidenced by the comparative strength of the parties-- for example, a giant corporation as compared to an average citizen.

In a very few situations dairy farmers have no contracts with their milk handler. In places where there is competition, the contract in often month-to-month. In the Northeast and elsewhere the contracts are for a year.

So, I suspect that many of the one year contracts are actual "adhesion contracts." The problem with adhesion contracts is the person on the bottom often (usually) has no resources to fight a case in court.

Friday, November 19, 2010

Not Enough

Today USDA released its "Outlook" report, which can be found at: http://www.ers.usda.gov/Publications/LDP/2010/11Nov/LDPM197.pdf

Here is the conclusion for dairy:

The report mentions higher feed prices but, there is no mention of the pricing system being broken.

Here is the conclusion for dairy:

Stronger NDM prices should partly offset lower butter prices, keeping Class IV prices firm over the course of 2011. Class IV prices, which are expected to average $14.45 to $15.45 per cwt in 2011, will be only slightly lower than the expected $15.05 to $15.25 per cwt average in 2010. Stronger domestic demand for cheese will boost the Class III price next year. In 2011, the Class III price is expected to average $14.40 to $15.30 per cwt, up from an average $14.35 to $14.45 this year. The all milk price is forecast to average $15.95 to $16.85 per cwt next year, very near the expected 2010 average of $16.30 to $16.40 per cwt.

The report mentions higher feed prices but, there is no mention of the pricing system being broken.

Thursday, November 18, 2010

Milk Production & Belief

(click on image to enlarge)

Today, the USDA'S "Milk Production" report came out. According to USDA production in the 23 lead dairy states was up 3.3 percent in October 2010. Who knows. Certainly some expert will use the data to suggest that the drop in price at the CME is justified. Those who believe in this drivel also believe the market system regulates supply and demand through price. Wrong.

Note: The 2011 data is USDA's projections

Wednesday, November 17, 2010

Heirarchy

(click on image to enlarge)

If you go to Wal-Mart's investor presentation at: http://media.corporate-ir.net/media_files/irol/11/112761/Transcripts/3Q11_transcript.pdf

on page 15 is: "Produce and dairy were our strongest categories." Note above what Dean is saying.

Supermarkets wear the pants in the dairy industry - they are on top. Next comes the processors and the farmers get what is left.

Tuesday, November 16, 2010

Not Goumet

http://www.stuff.co.nz/business/industries/4332036/Fonterras-added-value-plan-paying-off

Fonterra's added-value plan paying off

Fonterra ingredient technology + California's cheap milk = profit for someone but, the stuff wont win any prizes.

Fonterra's added-value plan paying off

Fonterra's strategy of adding value to other countries' milk to bring home fatter returns to New Zealand has made major strides in the United States, and a successful cheese and yoghurt ingredient manufacturing experiment is now being rolled out in Europe.

Using leased plant and milk supplied from US heavyweight co-operative California Dairies, Fonterra has made a cheddar cheese production breakthrough by applying Kiwi intellectual property from its Palmerston North research centre.

The new products would command premium prices in world food service markets, said Andrei Mikhalevsky, managing director, global ingredients and food services.

The venture has so far cost Fonterra US$7.5 million (NZ$9.6m), mainly to upgrade the ageing plant. Building a new factory would have cost up to US$70m, he said.

The first season's production of the new Cheddar Plus brand was small at about 13,000 tonnes but quickly sold out.

Production of a specialised yoghurt base at the same plant at Los Banos, between Los Angeles and San Francisco, has been similarly successful, though sales had been later starting because of US grading certification requirements.

"The cheese is basically a cheese ingredient that people would put into sliced cheese for application into the food service, where it might be used for hamburgers or cheddar slices for retail," Mr Mikhalevsky said.

He declined to forecast likely earnings from the new venture, but said Fonterra was aiming for a big slice of the US$19 billion world cheese ingredient market. T

he global market for all cheese is estimated to be worth US$91b.

"We have proved the model. We are not just talking about value-add, we have proved the concept. It's not a dream, it's now a reality."

The hunt is on for plants in Europe.

Fonterra ingredient technology + California's cheap milk = profit for someone but, the stuff wont win any prizes.

Monday, November 15, 2010

Straight PR

At:

http://www.prnewswire.com/news-releases/dairy-management-inc-and-americas-dairy-farmers-set-the-record-straight-107951839.html

Is:

Dairy Management Inc. and America's Dairy Farmers Set the Record Straight

But, but wait... on May 23, 2005 the U.S. Supreme Court:

"Held: Because the beef checkoff funds the Government’s own speech, it is not susceptible to a First Amendment compelled-subsidy challenge."

this case applied to "all" checkoff challenges, including dairy.

There is little doubt but that the top DMI people remember the Supreme Court shoring up their massive salaries. Talk about setting the record straight?

http://www.prnewswire.com/news-releases/dairy-management-inc-and-americas-dairy-farmers-set-the-record-straight-107951839.html

Is:

Dairy Management Inc. and America's Dairy Farmers Set the Record Straight

ROSEMONT, Ill., Nov. 14, 2010 /PRNewswire/ -- The New York Times and numerous media outlets this past week have inaccurately reported on the nation's farmer-funded dairy promotion program. Much of the reporting is fundamentally wrong. Contrary to the myth that has been perpetuated, Dairy Management Inc. was not created by the U.S. Department of Agriculture (USDA), nor is it an agency of USDA. It is a private, non-profit corporation created -- and run -- by America's dairy farmers who established it to unify national and local dairy promotion efforts.

All of the programs created by Dairy Management Inc. to promote dairy consumption in the U.S. are paid for completely by America's dairy farmers. No taxpayer dollars are used for our domestic marketing efforts. USDA does not contribute money to promote dairy products in the U.S. In fact, dairy farmers actually pay USDA for all of the costs to oversee the promotion program.

USDA performs a congressionally mandated oversight role over the collection and disbursement of dairy farmer's funds, and to ensure that our programs are consistent with the law that set up the program.

America's dairy farmers are proud of the nutritional contributions of milk and cheese to the U.S. diet and support the consumption of a balanced diet which includes room for all foods in moderation. The U.S. government's Dietary Guidelines for Americans, which call for the consumption of three servings of low-fat or fat-free milk products each day, are the cornerstone of Dairy Management's nutrition guidance.

The 56,000 dairy farm families represented by Dairy Management welcome and encourage people to learn more about the important dietary role of dairy in supplying nine key nutrients necessary for healthy bodies and welcome inquiries about their efforts to promote increased dairy consumption so that Americans get their three servings of dairy a day.

Efforts to misrepresent this program, and the federal government's role in administering the program, are an unfortunate and unacceptable assault on the hard work and dedication of America's dairy farmers.

But, but wait... on May 23, 2005 the U.S. Supreme Court:

"Held: Because the beef checkoff funds the Government’s own speech, it is not susceptible to a First Amendment compelled-subsidy challenge."

this case applied to "all" checkoff challenges, including dairy.

There is little doubt but that the top DMI people remember the Supreme Court shoring up their massive salaries. Talk about setting the record straight?

Sunday, November 14, 2010

Get Together

No one keeps any statistics on how many times dairy farmers are told they need to get together.

Looking at Barry Wilson's "Dairy Industry Newsletter" (on-line and print subscription = $1,000/year)I noticed a further breakdown of the data produced by Hoards on the 50 largest cooperatives.

Barry notes some of the largest producer co-ops, in terms of volume per farm, expanded production in 2009. Continental, for instance, produced 5% more per farm. So much for meaningful markets signals. The average Continental produced 61.44 million pounds in 2009.

Ten of those farm would produce all of the of the milk produced by 727 Lanco farmers.

So, would America be better off if more than 700 Lanco farmers went out of business? I think not.

So what exactly is meant by the idea of all dairy farms getting together? I personally think that is code for there will be no meaningful discussion of the complexities of dairy in high places.

Looking at Barry Wilson's "Dairy Industry Newsletter" (on-line and print subscription = $1,000/year)I noticed a further breakdown of the data produced by Hoards on the 50 largest cooperatives.

Barry notes some of the largest producer co-ops, in terms of volume per farm, expanded production in 2009. Continental, for instance, produced 5% more per farm. So much for meaningful markets signals. The average Continental produced 61.44 million pounds in 2009.

Ten of those farm would produce all of the of the milk produced by 727 Lanco farmers.

So, would America be better off if more than 700 Lanco farmers went out of business? I think not.

So what exactly is meant by the idea of all dairy farms getting together? I personally think that is code for there will be no meaningful discussion of the complexities of dairy in high places.

Saturday, November 13, 2010

Government

One cannot look at recent trading on the CME without questions coming to mind about the function of government.

Some hold that government is all about protection, particularly property, and those with the most to protect get the lions share of the governments attention. Adam Smith, the so-called father of capitalism, suggested the same and said those with the most to protect should pay the most in taxes. Maybe someone in the Tea Party mentioned Smith's view but, I don't recall hearing such.

Mostly, it seems the big push is for low taxes and less government.

However, Aristotle said, "It is in justice that the ordering of society is centered."

It is quite possible to have tyranny and have the rich and powerful shielded from harm.

A civil society, particularly one which claims to be a democracy, must truly focus on Justice.

I honestly don't see that happening in dairy.

Some hold that government is all about protection, particularly property, and those with the most to protect get the lions share of the governments attention. Adam Smith, the so-called father of capitalism, suggested the same and said those with the most to protect should pay the most in taxes. Maybe someone in the Tea Party mentioned Smith's view but, I don't recall hearing such.

Mostly, it seems the big push is for low taxes and less government.

However, Aristotle said, "It is in justice that the ordering of society is centered."

It is quite possible to have tyranny and have the rich and powerful shielded from harm.

A civil society, particularly one which claims to be a democracy, must truly focus on Justice.

I honestly don't see that happening in dairy.

Friday, November 12, 2010

Feed

At: http://usda.mannlib.cornell.edu/usda/current/FDS/FDS-11-12-2010.pdf

is the most recent "Feed Outlook", which begins:

I am not confident the current situation will be short term.

The Kansas Cit Federal Reserve just came out with a new report on "farmland investment." The report is at: http://www.kansascityfed.org/publicat/research/indicatorsdata/agcredit/AGCR3Q10.pdf

Here's an interesting quote from a bank, "Land fever is running rampant. It appears that the combination of low investment returns for financial assets and the generally strong farm sector has spurred a voracious appetite for agricultural land.‖ –NE Kansas"

is the most recent "Feed Outlook", which begins:

Lower forecast corn yields this month reduce U.S. corn production 124 million bushels to 12.54 billion. Fractional changes are made in sorghum, barley, and oats because of late harvests. Corn used for ethanol production is raised. Corn used domestically for feed and residual and for export are both lowered. These supply and use changes reduce projected ending stocks 75 million bushels. As projected, 2010/11 ending stocks would be the lowest since1995/96 and represent a carryout of 6.2 percent of projected usage. Price prospects for corn and sorghum are up this month. Foreign corn production is projected higher, with increased corn production in China. Rising foreign consumption combines with the smaller U.S. crop to leave global corn stocks at a 4-year low.

I am not confident the current situation will be short term.

The Kansas Cit Federal Reserve just came out with a new report on "farmland investment." The report is at: http://www.kansascityfed.org/publicat/research/indicatorsdata/agcredit/AGCR3Q10.pdf

Here's an interesting quote from a bank, "Land fever is running rampant. It appears that the combination of low investment returns for financial assets and the generally strong farm sector has spurred a voracious appetite for agricultural land.‖ –NE Kansas"

Thursday, November 11, 2010

2+2 = ?

The trade data came out yesterday. Altogether, the U.S. exported 4% more dairy product Jan - September 2010 than the same period in 2008.

The most recent "Commercial Disappearance" numbers only cover through August. Close enough. January through August of 2008 the milk equivalent was 127,432

(x 1 million) pounds. In 2010 it was 129,627 (x 1 million) pounds.

The average "all milk" price for January through September 2008 was $18.83 and for January through September 2010 it was $15.52 per hundredweight.

It really does not add up.

"In the case where it is a form of theft, distinguishing between embezzlement and larceny can be tricky." Wikipedia

The most recent "Commercial Disappearance" numbers only cover through August. Close enough. January through August of 2008 the milk equivalent was 127,432

(x 1 million) pounds. In 2010 it was 129,627 (x 1 million) pounds.

The average "all milk" price for January through September 2008 was $18.83 and for January through September 2010 it was $15.52 per hundredweight.

It really does not add up.

"In the case where it is a form of theft, distinguishing between embezzlement and larceny can be tricky." Wikipedia

Wednesday, November 10, 2010

Trade Data

You can probably go to many sites to see information on September's exports of dairy products. We exported a lot. We exported 3.2% of all cheese production. We exported 75.8% of all NFDM/SMP production.

Of course, we imported 67% more MPCs in September than we imported in September 2009. For the year-to-date we imported 8.3% more MPCs. Made a lot more cheese with all those MPCs.

Of course, we imported 67% more MPCs in September than we imported in September 2009. For the year-to-date we imported 8.3% more MPCs. Made a lot more cheese with all those MPCs.

Tuesday, November 9, 2010

Dean

http://www.cnbc.com/id/40086665

"These results are clearly disappointing for us and reflect continued significant challenges in our largest business, Fresh Dairy Direct-Morningstar," said Gregg Engles, Chairman and Chief Executive Officer."

Kraft is having cash flow problems and now Dean. Any mystery regarding where they expect the money to come from?

"These results are clearly disappointing for us and reflect continued significant challenges in our largest business, Fresh Dairy Direct-Morningstar," said Gregg Engles, Chairman and Chief Executive Officer."

Kraft is having cash flow problems and now Dean. Any mystery regarding where they expect the money to come from?

Monday, November 8, 2010

Who Knows?

What is happening on the CME? Last week Kraft came and traded a few loads of cheese. Jerome, which might be simply following has sold the most loads. Mullins has traded a few loads. None of this answers the question of why? I think the following might be a key.

http://www.cnbc.com/id/38241893

Kraft needs cash and it is OK with the government if the powerful take what they need from those with less power.

Near as I can find Hoogwegt (http://www.hoogwegtus.com/) offered the butter Friday and AMPI bought the load.

The seller does not make butter. The buyer does. Is that a real market? I think NOT.

Today, it appears that Dairygold bid the price back up 12 cents. Probably in an effort to protect the value of their inventory. Once again a producer of butter is bidding.

The 1996 study on the National Cheese Exchange repeatedly referred to "trading against interest" as a sign of market failure.

The election is over and it seems there was a clambering for less government. Is there anyone holding their breathe while the government contemplates the dairy trading on the CME?

http://www.cnbc.com/id/38241893

More than 150 companies with market caps above $500 million that claim they have free cash flow—really don't!

That's the word from Ken Hackel, who wrote the just-published tome (and I do mean tome): "Security Valuation and Risk Analysis – Assessing Value in Investment Decision Making."

You should care, because free cash flow is the lifeblood of any company looking to grow.

And free cash flow was touted as a plus quite a bit in the recent round of earnings.

Hackel isn’t impressed. "The term 'free cash flow' has almost gotten to be like the old television show 'What's My Line',” he says. “What free cash flow should be defined as is the maximum amount of cash an entity could distribute to its shareholders without impairing its growth rate. Unfortunately, we've gotten quite a bit away from that."

The free cash flow definition most people use is operating cash flow minus capital spending.

But Hackel says that true free cash flow requires a lot more in the way of adjustments—the kind he believes most analysts simply do not do.

Among companies whose cash flow he believes are flashing red:

Kraft [KFT 31.12 0.04 (+0.13%) ], whose revenues missed estimates and which didn’t include a cash flow statement with its earnings release or discuss it on its earnings call. Still, using available information, Hackel believes he was able to analyze the cash flow and say, “Their backs are really against the wall; they have no room for expansion; they do not have financial flexibility."

Kraft disagrees, saying that over the past few years it has made excellent progress improving free cash flow. "In 2010, there are a number of puts and takes in the equation, due to the acquisition of Cadbury. However, on a more normal run-rate basis, we would expect cash flow to be north of about $3.5 billion.”

Kraft needs cash and it is OK with the government if the powerful take what they need from those with less power.

Near as I can find Hoogwegt (http://www.hoogwegtus.com/) offered the butter Friday and AMPI bought the load.

The seller does not make butter. The buyer does. Is that a real market? I think NOT.

Today, it appears that Dairygold bid the price back up 12 cents. Probably in an effort to protect the value of their inventory. Once again a producer of butter is bidding.

The 1996 study on the National Cheese Exchange repeatedly referred to "trading against interest" as a sign of market failure.

The election is over and it seems there was a clambering for less government. Is there anyone holding their breathe while the government contemplates the dairy trading on the CME?

Sunday, November 7, 2010

Restaurants

(click on image to enlarge)

The good news is that full service restaurants are doing quite well - at least according to the Bloomberg Index.

However, the New York Times has an article should be read:

http://www.nytimes.com/2010/11/07/us/07fat.html?pagewanted=1&_r=1&hpw

The article has generated a great deal of backlash against dairy farmers on Twitter. Naturally, the article should be of concern. But, has the increase in per capita cheese consumption really benefited dairy farmers?

Funny, there seems to be no problem in France with cheese consumption and obesity.

Saturday, November 6, 2010

Dollar

(click on image to enlarge)

Since we live in a global economy (like it or not), the relative value of the U.S. dollar is important to dairy farmers.

On the one hand, imports of most dairy products will be curbed. But, exports of grains, particularly soy and corn, will be driven by a low U.S. dollar. So, don't count on cheap grain anytime in the near future.

Friday, November 5, 2010

How Low?

By asking the question, how low, I do not intend to guess out future CME prices. The question I am asking is how low will the powerful stoop relative to human decency.

Today's CME prices indicate there is no honor among the thieves. Trading a few loads on the CME impacts supply/demand hardly at all. Anything traded on the CME could be traded off the CME. This can and does happen all the time. The only thing trading at the CME really affects is farm milk price.

December Class III is $13.56.

Blocks today are $1.48. For comparison world price (FOB Oceania) is is $1.86.

Butter fell $0.27 today to close on the CME at $1.88. World price for butter adjusted to 80% butterfat is $2.32. No One can make the case that there is too much butter.

Today's CME prices indicate there is no honor among the thieves. Trading a few loads on the CME impacts supply/demand hardly at all. Anything traded on the CME could be traded off the CME. This can and does happen all the time. The only thing trading at the CME really affects is farm milk price.

December Class III is $13.56.

Blocks today are $1.48. For comparison world price (FOB Oceania) is is $1.86.

Butter fell $0.27 today to close on the CME at $1.88. World price for butter adjusted to 80% butterfat is $2.32. No One can make the case that there is too much butter.

Thursday, November 4, 2010

Farm Milk Prices

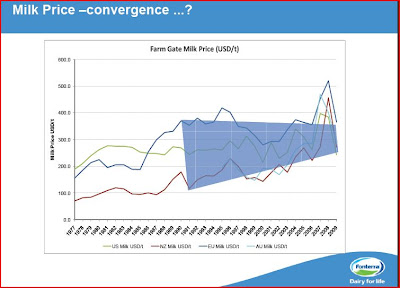

(click on image to enlarge)

Note: I enlarged the section (11/06/10) to show the detail better. U.S. is the green line and NZ the red line.

Take a close look at the above graph. Where is New Zealand's farm milk price relative to the U.S.? The above graph by Fonterra does not show 2010 but, it is higher for NZ.

Wednesday, November 3, 2010

What's Happening

http://www.marketintelligencecenter.com/newsbites/1221395

"Kraft Foods (NYSE: KFT) opened at $31.81. So far today, the stock has hit a low of $31.59 and a high of $32.00. KFT is now trading at $31.67, down $0.17 (-0.53%). The stock hit its 52-Week high of $32.67 in October and set its 52-Week low of $26.31 last November. The company will report Q3 earnings tomorrow, with analysts expecting to see $0.46 per share, versus $0.55 during the same period last year. Technical indicators for the stock are neutral and S&P gives KFT a neutral 3 STARS (out of 5) hold ranking. If you are looking for a hedged play on KFT the stock seems like it could be a candidate for a January out-of-the-money bull-put credit spread below the 28 range."

Crashing prices on the CME might seem like a good plan, except...there will be a train wreck. This is not capitalism at work, this is power, raw power.

"Kraft Foods (NYSE: KFT) opened at $31.81. So far today, the stock has hit a low of $31.59 and a high of $32.00. KFT is now trading at $31.67, down $0.17 (-0.53%). The stock hit its 52-Week high of $32.67 in October and set its 52-Week low of $26.31 last November. The company will report Q3 earnings tomorrow, with analysts expecting to see $0.46 per share, versus $0.55 during the same period last year. Technical indicators for the stock are neutral and S&P gives KFT a neutral 3 STARS (out of 5) hold ranking. If you are looking for a hedged play on KFT the stock seems like it could be a candidate for a January out-of-the-money bull-put credit spread below the 28 range."

Crashing prices on the CME might seem like a good plan, except...there will be a train wreck. This is not capitalism at work, this is power, raw power.

Tuesday, November 2, 2010

Election Predictions

At this point in time, one can safely bet, with the elections nearly over, we can go back to nothing happening in dairy policy. How many ways can "gridlock" be spelled.