I have a new host for the blog. The URL is: http://johnbuntingsjournal.com

There will be some time before I am familiar with the workings of Wordpress, but, that's life.

I will post something later today.

Pass the word and let me know what you think.

Sunday, May 15, 2011

Friday, May 13, 2011

Wednesday, May 11, 2011

Money Talks

(click on images to enlarge)

The stock market fell. Oil fell. Corn, wheat, soybean futures fell. The dollar is up. Is there a pattern?

No surprise that butter futures fell, the limit, a nickel. No surprise that Class III milk futures fell. But, look above at the Commodity Futures Trading Commission (CFTC) "Commitment of Traders" report. Look at how few players participate. Then ask why "non-commercial" players should even be there.

Don't worry though. These are really smart people who know more than the mere mortal.

Tuesday, May 10, 2011

Dean Defies Predictions

Some insiders felt Dean would fall very short on first quarter earning. Instead, they pulled a rabbit out of the hat:

http://www.prnewswire.com/news-releases/dean-foods-reports-first-quarter-2011-results-121555323.html

In the first half hour of trading today Dean shares were up over 14%. At the closing bell Dean shares were up 11.48%.

Oddly enough, Dean saw sales volume for fluid drop and the Class I mover rise dramatically when compared with the first quarter of 2010. Greg Engles said on the conference call he expected farm milk price to remain steady for the rest of the year. But, what does he know?

As Yogi Berra once said, "It's tough to make predictions, especially about the future."

http://www.prnewswire.com/news-releases/dean-foods-reports-first-quarter-2011-results-121555323.html

In the first half hour of trading today Dean shares were up over 14%. At the closing bell Dean shares were up 11.48%.

Oddly enough, Dean saw sales volume for fluid drop and the Class I mover rise dramatically when compared with the first quarter of 2010. Greg Engles said on the conference call he expected farm milk price to remain steady for the rest of the year. But, what does he know?

As Yogi Berra once said, "It's tough to make predictions, especially about the future."

Monday, May 9, 2011

Crop Progress

(click on images to enlarge)

Today, May 9, 2011 USDA's "Crop Progress" report was released. The full report is at: http://usda.mannlib.cornell.edu/usda/current/CropProg/CropProg-05-09-2011.pdf

The two snips above show planting is progressing. However, the amount emerged is way behind average. The temperature has not been conducive to corn within the corn growing states. Additionally, there are reports of 900,000 acres under water.

Just what this will all mean when the harvest season comes is anyone's guess. A study on various prediction models (not for the corn crop) indicates people are not very good. So, what will come of dairy ration price is yet to be known.

Sunday, May 8, 2011

Weather

http://www.blogger.com/img/blank.gif

http://www.blogger.com/img/blank.gif(click on image to enlarge)

Although much of the focus of the news is on the Mississippi flooding there are still vast areas of the country experiencing drought (see above).

An interesting news story focuses on the extreme effects of La NinaL

http://news.yahoo.com/s/ap/20110508/ap_on_re_us/us_la_nina_s_extremes

The winter and early spring have been extreme across the West, with record snowpacks bringing joy to skiers and urban water managers but severe flood risks to northern Utah, Wyoming and Montana.

And despite all the wet weather in the Rockies and Sierra Nevada, parts of eastern Colorado, New Mexico and Arizona are in severe drought and gearing up for what is forecast as a bad fire season. In New Mexico, some 400 fires, driven by relentless winds, have already raced across 315,000 acres.

Credit — or blame — for the extreme weather goes mostly to a strong La Nina, which is associated with cooler than normal water temperatures in the Equatorial Pacific Ocean and an atmospheric flow that's causing drier than normal conditions in the Southwest and wetter than normal in the Northwest..

More at link.

Saturday, May 7, 2011

Tornado Victims

I learned today of one dairy farmer in Alabama who just got his power back on ten days after the tornado.

A couple days ago I received this:

FYI:

Federation of Southern Cooperatives is taking donations to help the Alabama tornado victims.

Requested Items

* towels

* tooth paste

* canned foods

* can openers

* cooking utensils

* cleaning supplies

* socks

* washing powder

* soap

* underwear

* water

* toiletries

* bathroom tissue

* clothing

* cash donations are accepted (all donations are tax-deductable)

o Make all checks payable to the Federation of Southern Cooperatives

Please send all item donations via UPS to:

Debra Eatman

575 Federation Rd

Gainsville, Ala 35464

A couple days ago I received this:

FYI:

Federation of Southern Cooperatives is taking donations to help the Alabama tornado victims.

Requested Items

* towels

* tooth paste

* canned foods

* can openers

* cooking utensils

* cleaning supplies

* socks

* washing powder

* soap

* underwear

* water

* toiletries

* bathroom tissue

* clothing

* cash donations are accepted (all donations are tax-deductable)

o Make all checks payable to the Federation of Southern Cooperatives

Please send all item donations via UPS to:

Debra Eatman

575 Federation Rd

Gainsville, Ala 35464

Friday, May 6, 2011

Commodities Drop Again

Big money is running, looking for safe places. The U.S. dollar seems to be that place, which results, since commodities are denominated in dollars, in falling oil, corn and other commodities.

Yesterday a new study came out: http://www.economist.com/node/18648350?story_id=18648350

The study seems to explain, to some extent, the fall globally, in crop yields. However,we seemed to have missed, so far, negative impacts. The article concludes:

Yesterday a new study came out: http://www.economist.com/node/18648350?story_id=18648350

The study seems to explain, to some extent, the fall globally, in crop yields. However,we seemed to have missed, so far, negative impacts. The article concludes:

That might be keenly felt if patterns of warming shift. One of the reasons that the climate effects Dr Lobell and his colleagues have dug out of the data are not worse is that, although the planet as a whole has warmed up during the past 30 years, growing seasons in the parts of America which produce 40% of the world’s maize and soyabeans have failed to follow suit. No one is quite sure why this might be and no one knows if it will last. That climate change has not yet done very much harm may be cheering, but the past offers no firm guarantees for the future.

Thursday, May 5, 2011

Commodities fall

Commodities fell today. Oil fell, corn fell. It is too wet to plow and corn futures fell. So much for supply and demand and hooray for the Commodity Futures Modernization Act of 2000 which allow big money to hedge things like corn against speculating on the dollar.

Needless to say the dollar took off in an upward flight.

What all this will mean to dairy farmers is too soon to tell. But,all bets are off.

Needless to say the dollar took off in an upward flight.

What all this will mean to dairy farmers is too soon to tell. But,all bets are off.

Dean Settlement Approved

http://www.burlingtonfreepress.com/article/20110505/NEWS01/110505016/Burlington-judge-grants-preliminary-approval-revised-Dean-Foods-settlement?odyssey=mod|newswell|text|FRONTPAGE|s

Essentially, Dean settled for what might have been its costs to defend itself in the case. Not bad. And, as things stand, we have learned nothing and nothing has changed.

Most everyone had hoped for more - much more.

U.S. District Court Judge Christina Reiss granted preliminary approval Wednesday to a revised Dean Foods settlement in the class action lawsuit being brought on behalf of Northeast dairy farmers, clearing the way for the plaintiffs to begin notifying farmers of the $30 million payment Dean has agreed to make to settle the case.

Attorneys for the plaintiffs, which include two Vermont dairy farmers, have estimated that about 8,000 farmers will be entitled to a share of the settlement. They have characterized the case as the first step in breaking Dean’s grip on the milk market, restoring competitoin to the marketplace. Dean is the largest milk processor in the country.

The two other defendants in the lawsuit, Dairy Farmers of America, and its marketing arm, Dairy Marketing Services, have refused to settle, and have said the lawsuit is pitting dairy farmer against dairy farmer. Dairy Farmers of America is the largest dairy farmer cooperative in the nation and includes hundreds of Vermont dairy farmers.

About two dozen farmers belonging to the Dairy Farmers of America coop attended an April 15 hearing on the case in Reiss’s court to show their opposition to the lawsuit. The farmers have said a provision of the lawsuit that would require Dean to buy at least 10 percent of its milk from a source other than Dairy Farmers of America would ultimately lead to lower milk prices and could put some of them out of business.

But as Judge Reiss noted in her decision Wednesday, that provision of the lawsuit was dropped in its revised version, clearing the way, in her opinion, for the $30 million settlement to go forward. Reiss noted in her opinion that the requirement to buy milk from sources other than Dairy Farmers of America "has been the sole source of objections to the Dean Settlement."

"We’re pleased with the Court’s decision and believe this is a very good outcome for the farmers represented in this case," said Benjamin Brown of Cohen Milstein Sellers Toll, PLLC, the Washington D.C. law firm bringing the lawsuit. "We are continuing to move the case forward against the remaining defendats, DFA and DMS, and expect to complete factual discovery in the case in the next month."

Attorneys for Dairy Farmers of America were still reviewing Reiss’s decision Thursday morning.

Essentially, Dean settled for what might have been its costs to defend itself in the case. Not bad. And, as things stand, we have learned nothing and nothing has changed.

Most everyone had hoped for more - much more.

Wednesday, May 4, 2011

Decling World Yields

http://www.blogger.com/img/blank.gif

http://www.blogger.com/img/blank.gif(click on image to enlarge)

http://greedgreengrains.blogspot.com/2011/05/declining-crop-yields.html

Declining crop yields

There are many reasons for high commodity prices. But recent data from FAO shows a pretty rapid slowdown in productivity growth. The price spike in 2008 occurred in a particularly bad year in which yields declined on a worldwide basis for three of the four largest food commodities. In 2009 all four of the majors saw yield declines, something that hasn't happened since 1974. 2010 couldn't have been much better and was probably worse, given how bad things were in the U.S, the world's largest producer and exporter (worldwide data for 2010 isn't available yet).

More at link.

Probably, there are several reasons but, obviously, Monsanto is not going to feed the world.

Tuesday, May 3, 2011

Corn & Money

(click on image to enlarge)

Yesterday USDA's "Crop Progress" report was released: http://usda.mannlib.cornell.edu/usda/current/CropProg/CropProg-05-02-2011.pdf

Above shows the how little corn has been planted. Yesterday, the decision was made to flood thousands of acres of cropland. One might think corn prices might have skyrocketed today - not so.

Weather may be important. Supply and demand may be important. But, the almighty (or not so almighty) dollar seems to reign.

Dairy farmers will certainly face a stiffer grain bill.

Monday, May 2, 2011

Cheese

Today, USDA released its "Dairy Products" report which covers March 2011. American type cheese production was up 0.3 % when compared with March 2010. USDA's "Commercial Disappearance" data came out recently which showed a 12% increase in sales of American type cheese. That is a huge change. Most of the increase came from exports.

Speaking with a cheese broker today, I learned there are hamburger price "war" currently. he felt that should bump up cheese consumption.

Altogether, the situation should provide a healthy price at the CME. But, do the traders really know what is happening in the real world?

Speaking with a cheese broker today, I learned there are hamburger price "war" currently. he felt that should bump up cheese consumption.

Altogether, the situation should provide a healthy price at the CME. But, do the traders really know what is happening in the real world?

Sunday, May 1, 2011

New Checkoff Needed?

(Click on image to enlarge)

While dairy farmers pay into the dairy checkoff, dairy farmers seem to be using less milk on the farm. The USDA data only goes to 2004. Lately according to sources, dairy farmers are cutting milk replacer to save money.

The data shows, however, dairy farmers have been cutting farm milk use at a faster pace than the consumer.

Saturday, April 30, 2011

Balancing Act

(click on image to enlarge)

Milk leaves the farm and theoretically goes to the highest use, which has historically fluid milk. Eventually, when no other home can be found, the milk goes to a nonfat dry milk plant, which is considered the lowest value.

This process is called balancing. But, there is another aspect. The government stands ready willing and able to buy dairy products at the "support" price of $9.90 per hundredweight or for NFDM $.80 per pound.

A look at the graph above should be all the proof anyone needs that sales to the government is an act for reasons known to the big players. For the most part, the sales to the government correspond with low farm milk price and sales to the government are considered "surplus." Logically, the manufacturers warehouses should be filled to the brim. However, that seems to have not been the case.

Friday, April 29, 2011

Food Costs

http://www.blogger.com/img/blank.gif

http://www.blogger.com/img/blank.gif(click on image to enlarge)

ERS has new data on food inflation: http://www.ers.usda.gov/Briefing/CPIFoodAndExpenditures/Data/CPIForecasts.htm

Dairy shows some increase in costs but, not as much as meat. Anyone can practically live on dairy. However, George Orwell noted some time ago in The Road to Wigan Pier, regarding the life of the British working poor:

The basis of their diet, therefore, is white bread and margarine, corned beef, sugared tea and potatoes -- an appalling diet. Would it not be better if they spent more money on wholesome things like oranges and wholemeal bread or if they even, like the writer of the letter to the New Statesman, saved on fuel and ate their carrots ? Yes, it would, but the point is that no ordinary human being is ever going to do such a thing. The ordinary human being would sooner starve than live on brown bread and raw carrots. And the peculiar evil is this, that the less money you have, the less inclined you feel to spend it on wholesome food. A millionaire may enjoy breakfasting off orange juice and Ryvita biscuits; an unemployed man doesn't.… When you are unemployed … you don't want to eat dull wholesome food. You want something a little bit "tasty." There is always some cheaply pleasant to tempt you.

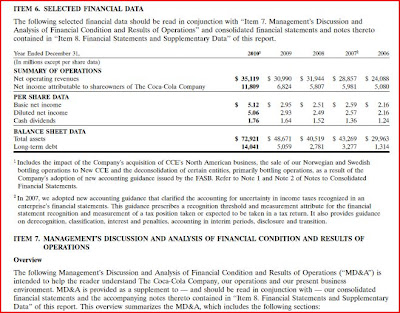

All of which leads to Coke's annual report: http://www.thecoca-colacompany.com/investors/pdfs/form_10K_2010.pdf

A snip can be seen above. Coke had a reduction of 3%, 2008 vs 2009.

then look at: http://usda.mannlib.cornell.edu/usda/current/MilkProdDi/MilkProdDi-04-27-2011.pdf

On page 6 you will find dairy farms lost 30% in the same 2008 - 2009 period.

Thursday, April 28, 2011

Plates

http://www.blogger.com/img/blank.gif

http://www.blogger.com/img/blank.gif(click on image to enlarge)

There is an interesting site which focuses on the tectonic plate which produced the recent earthquakes in New Zealand: http://nzphoto.tripod.com/volcano/PlateMotion.htm

Equally important, is that the Pacific plate produced the massive earthquake and tsunami in Japan.

Japan is enduring rolling blackouts everyday as its electrical generation capacity is reduced from the tsunami and the nuclear disaster. Earlier this week, I spoke with someone who had just returned from Japan. he said Japanese dairy farmers had driven their cows into Tokyo as a protest. he also said it will be at least two months before Japan is able to evaluated with any certainty where things are headed. The Bank of Japan confirmed this in a report out today.

Fonterra has withdrawn all employees from Japan. Some think America will be exporting y more dairy products to Japan soon.

One more thing, the Pacific Plate touches the West coast of the U.S.

Wednesday, April 27, 2011

Framing the Discussion

In recent days I have heard multiple time the concept of a "competitive" price. What exactly is a competitive price? who knows?

But, first a thought as to why terms like "competitive price" are used.

http://en.wikipedia.org/wiki/Framing_(social_sciences)

Naturally, when one hears the term "competitive pricing" regarding farm milk, anyone is likely to think everyone is going to run the price up for my milk. Not likely. Everyone should make a list of all the dirty tricks used to drive down farm milk price and then double the number.

Careful of term which shortcut thinking.

But, first a thought as to why terms like "competitive price" are used.

http://en.wikipedia.org/wiki/Framing_(social_sciences)

Framing, a term used in media studies, sociology and psychology, refers to the social construction of a social phenomenon by mass media sources or specific political or social movements or organizations. It is an inevitable process of selective influence over the individual's perception of the meanings attributed to words or phrases. A frame defines the packaging of an element of rhetoric in such a way as to encourage certain interpretations and to discourage others.

Framing is so effective because it is a heuristic, or mental shortcut. According to Susan T. Fiske and Shelley E. Taylor, human beings are by nature “cognitive misers”, meaning they prefer to do as little thinking as possible. Frames provide people a quick and easy way to process information. Hence, people will use the previously mentioned mental filters (a series of which is called a schema) to make sense of incoming messages. This gives the sender and framer of the information enormous power to use these schemas to influence how the receivers will interpret the message.[

Naturally, when one hears the term "competitive pricing" regarding farm milk, anyone is likely to think everyone is going to run the price up for my milk. Not likely. Everyone should make a list of all the dirty tricks used to drive down farm milk price and then double the number.

Careful of term which shortcut thinking.

Tuesday, April 26, 2011

Trucking

(click on image to enlarge)

There is a great deal of talk about the wonderful opportunities for the U.S. in dairy trade. Who knows how much will filter to the farm gate?

However, all of this is not as simple as it seems. Fuel costs are rising and one might think since the fuel is denominated in dollars the costs would be higher getting dairy out of the U.S. Well, it seems, having a back haul of some sort for all those containers is a deal sweetener.

But wait, most of the cheese is coming from the upper Midwest, where there are no refrigerated containers. Now there has to be a haul to a port via truck, where the cargo is then loaded to a container.

Needless to say, no one can look at any one set of numbers and grasp the whole financial impact. Every deal is unique.

Monday, April 25, 2011

Predictions

Everybody wants their future told. Go to any meeting on dairy and there will be no shortage of predictions about what the future of dairy prices will be.

However, just how good are the experts? While we may not know how good dairy experts are, no one has done any scientific study, there have been scientists study the accuracy of expert predictions. In the mid-1980s psychologist Philip Tetlock assembled a group of 284 political experts to make nearly 100 predictions each about a variety of possible future events. Twenty years later, he published the results. The experts did not perform any better then minimally sophisticated statistical model.

Other studies have come to the same conclusion. Experts are not very good at predictions, however, few people verify the predictions experts make.

Presently, there are so many balls in the air and any one of them or several of them might drop. Therefore, predictions about future dairy prices are virtually meaningless.

However, just how good are the experts? While we may not know how good dairy experts are, no one has done any scientific study, there have been scientists study the accuracy of expert predictions. In the mid-1980s psychologist Philip Tetlock assembled a group of 284 political experts to make nearly 100 predictions each about a variety of possible future events. Twenty years later, he published the results. The experts did not perform any better then minimally sophisticated statistical model.

Other studies have come to the same conclusion. Experts are not very good at predictions, however, few people verify the predictions experts make.

Presently, there are so many balls in the air and any one of them or several of them might drop. Therefore, predictions about future dairy prices are virtually meaningless.

Sunday, April 24, 2011

Mail Box Tells More

Saturday, April 23, 2011

Gaming the System

(click on images to enlarge)

Having full supply contracts with major processors means all milk to those processors has to go through the holder of the contract.

If you look at the map above and if you ship milk in FMMO I you will not find any data as to where your milk was pooled. But, it is obvious whoever holds the keys to pooling hold the keys to the treasure chest. Since Federal Order reform of 2000, "paper pooling" has been allowed. That is the milk does not have to regularly go to a plant to be pooled on a plant. The truck driver knows where the milk goes but, who knows on what plant the milk was pooled.

If you look at the list above you will se that in June 2010 three farms from New Mexico were "pooled" on the federal order based in Atlanta, Georgia. Do those farmers benefit from that pooling. If you look at the "mailbox" price, it is very doubtful that the actual farms saw actual benefits to the pooling games.

It is all nasty business with "official" approval.

Friday, April 22, 2011

No Competition

(click on images to enlarge)

The Vermont Attorney General has several items from the so-called Northeast case on its website.

One document is particularly interesting and is at the above link. The pages above are from that link.

Obviously, where there is no competition, prices to dairy farmers are depressed. this is what is known as a "horizontal agreement" and is illegal. Additionally, DFA/DMS is party to a long standing consent decree and this type of "deal" is a violation of that agreement with the U.S. Department of Justice.

This case results from government, particularly, the U.S. government not following their own laws:

The Code of Federal Regulations states:

608c(7)

(7) Terms common to all orders

In the case of the agricultural commodities and the products thereof specified in subsection (2) of this section orders shall contain one or more of the following terms and conditions:

(A) Prohibiting unfair methods of competition and unfair trade practices in the handling thereof.

Where is USDA? Where is DOJ? That's right, according to the so-called man on the street. the people want less government. Nobody wants an intrusive, oppressive government but, as the ancient Greeks said, "Who will guard us from the guards."

http://www.atg.state.vt.us/assets/files/DFOA%20Plaintiffs%20Reply%20Memo.pdfhttp://www.blogger.com/img/blank.gif

Thursday, April 21, 2011

Presented For Your Consideration

(click on image to enlarge)

http://www.youtube.com/watch?v=NzlG28B-R8Y

There is a fifth dimension, beyond that which is known to Man. It is a dimension as vast as space, and as timeless as infinity. It is the middleground between light and shadow, between science and superstition; and it lies between the pit of Man's fears, and the summit of his knowledge. This is the dimension of imagination. It is an area which we call...the Twilight Zone.

—Rod Serling, Opening Narration

There are some things more difficult to fathom than others. The above came as an email, along with a follow up call.

Wednesday, April 20, 2011

IDFA Policy

International

Dairy Foods Association (IDFA), the processor's lobby has some new dairy policy thoughts at: http://www.keepdairystrong.com/files/IDFA%20Dairy%20Policy%20Recommendations%20April%202011.pdfhttp://www.blogger.com/img/blank.gif

On page 5 we find:

In the sentence preceding the above, IDFA complains about the current system, "This program

keeps milk from moving to its highest-value use"

Dennis Wolff, who works for both IDFA and DPAC has been touting a bill from the 110th congress S1721, sponsored by former Pennsylvania senator Specter and Pennsylvania senator Casey.

Of course S1722 the so-called "Specter-Casey" bill of the 110th congress which became S1645 in the next congress and called for for a two price system.

And then we have, Dairy Policy Action Coalition (DPAC) which has "Cornerstones For Change"

http://www.dpac.net/publication_files/cornerstones-summary.pdf

The words of IDFA and DPAC are virtually identical.

Well at least we know who the man (Wolff) is behind two curtains._

Dairy Foods Association (IDFA), the processor's lobby has some new dairy policy thoughts at: http://www.keepdairystrong.com/files/IDFA%20Dairy%20Policy%20Recommendations%20April%202011.pdfhttp://www.blogger.com/img/blank.gif

On page 5 we find:

IDFA proposes that all end product price formula based minimum prices under

the FMMO system be eliminated. All dairy plants will pay whatever competitive

price is necessary to secure a supply of farm milk; there is no minimum Federal

order price that any plant must pay to independent dairy farmers or cooperatives.

In the sentence preceding the above, IDFA complains about the current system, "This program

keeps milk from moving to its highest-value use"

Dennis Wolff, who works for both IDFA and DPAC has been touting a bill from the 110th congress S1721, sponsored by former Pennsylvania senator Specter and Pennsylvania senator Casey.

S.1721

To amend the Farm Security and Rural Investment Act of 2002 to promote growth and opportunity for the dairy industry in the United States, and for other purposes. (Introduced in Senate - IS)

http://www.blogger.com/img/blank.gif

SEC. 6. FEDERAL MILK MARKETING ORDERS.

(a) 2-Class System for Classifying Milk-

Of course S1722 the so-called "Specter-Casey" bill of the 110th congress which became S1645 in the next congress and called for for a two price system.

And then we have, Dairy Policy Action Coalition (DPAC) which has "Cornerstones For Change"

http://www.dpac.net/publication_files/cornerstones-summary.pdf

SOLUTIONS: Simplify the milk pricing system.

• 1) Simplify 4 milk classes to 2.

• 2) Establish competitive pay pricing and move away from end-product-pricing formulas that

“pigeon-hole” the milk.

• 3) Adopt a federal pricing system that encourages movement of milk to its highest value use.

• 4) Adopt federal dairy policies that encourage competition, product innovation, and market

development.

The words of IDFA and DPAC are virtually identical.

Well at least we know who the man (Wolff) is behind two curtains._

Tuesday, April 19, 2011

School Food

(click on images to enlarge)

Just how important children are in America can be seen Here:

http://www.schoolfoodfocus.org/site/wp-content/uploads/2010/06/School-Food-101-Cost-of-School-Lunch.pdf

What you will find is that on average, in America, there is just one dollar per child for school lunch.

School Food Focus is try to improve the nutrition content of school food but, there is no way they can provide more money. More money only goes to banks and bankers.

The photo above should be titled "Do not try this at home." Look at the ingredients! Caution, the product contains wheat and soy. No need to have a caution about dairy.

Monday, April 18, 2011

Northeast Milk Supply/Dean Settlement

To hear the DFA conditioned farmers tell it, there is so, so much milk in the Northeast that if they cannot get it into the Dean plants involved in the NE settlement, they will get less money.

Here are a couple stories:

http://www.uticaod.com/news/x1798429123/Chenango-Co-s-Chobani-yogurt-hopes-to-be-No-1-yogurt-soon

http://www.uticaod.com/news/x1274023574/Yogurt-plants-boost-state-s-dairy-industry

According to sources, DFA/DMS has a full supply agreement with Chobani. Obviously, they cannot supply the Chobani plant.

However, DFA's ploy really has nothing to do with supply, but rather, with trying to disrupt class certification in the class action lawsuit. Without class certification there is no suit.

Here are a couple stories:

http://www.uticaod.com/news/x1798429123/Chenango-Co-s-Chobani-yogurt-hopes-to-be-No-1-yogurt-soon

http://www.uticaod.com/news/x1274023574/Yogurt-plants-boost-state-s-dairy-industry

But Chobani has expanded so rapidly that dairy farmers haven’t been able to grow the size of their herds as fast as the company needs, Ulukaya said.

“The demand is so high that it comes from every corner of the state,” Ulukaya said, of the milk. “Yet, we need more.”

The need for milk is a major reason why Ulukaya doesn’t know whether he will expand in this state or another, he said. The Chenango County plant will stay in place either way, but he has been in discussion with state farmers about whether they can handle further expansion by Chobani, he said.

According to sources, DFA/DMS has a full supply agreement with Chobani. Obviously, they cannot supply the Chobani plant.

However, DFA's ploy really has nothing to do with supply, but rather, with trying to disrupt class certification in the class action lawsuit. Without class certification there is no suit.

Sunday, April 17, 2011

Influence

(click on images to enlarge)

images from Open Secrets

Two roads lead to profit for large food corporations. Both must be taken. First costs must be reduced. There are limits unless one chooses to substitute real food for fake food.

The second road leads to D.C. Years of effort went into making certain the public was not short changed. Now, it would seem, honesty in food is being seriously eroded.

Both consumers and dairy farmers are paying a price. You will notice that Kraft really seems to not care which party is in power - they pay to the powerful.

Saturday, April 16, 2011

Cheese?

(click on images to enlarge)

While there is much talk about supply management and constant talk about dairy farmers farmers over producing, the "problem" probably is not the real problem.

Consider the common blue box. Kraft claims cheese, but the ingredients show no cheese - none.

Several agencies have authority over labeling, including the Federal Trade Commission, none have seen fit to do anything.

So what does it take to make certain cheese really is cheese?

Friday, April 15, 2011

Dean News

(click on image to enlarge)

In the northeast case Judge Reiss is considering a partial settlement:

http://www.burlingtonfreepress.com/article/20110415/NEWS01/110415033/0/BUSINESS03/Federal-judge-considers-severing-settlement-Dean-Foods-case-?odyssey=nav|headhttp://www.blogger.com/img/blank.gif

While she hasn't decided whether DFA or DMS have a standing to oppose the settlement, Reiss said farmers would have a chance to oppose it at a fairness hearing before she decides whether or not to give it final approval. If she gives the settlement preliminary approval, notices would go out to the farmers represented in the lawsuit in 10 states.

(more at link)

Forbes has a couple items on Dean Foods, the first is on Greg Engles compensation: http://www.forbes.com/lists/2011/12/ceo-compensation-11_Gregg-L-Engles_XU3T.html

Next is on bad management: http://blogs.forbes.com/frederickallen/2011/04/14/americas-best-and-worst-bosses-for-the-buck/

The least effective: Gregg L. Engles of Dean Foods. His paycheck has averaged $20 million a year over the past six years, while his company’s average return has been -11%.

Thursday, April 14, 2011

Dean Settlement Hearing April 15th

"Ignorance is preferable to error, and he is less remote from the truth who believes nothing than he who believes what is wrong.' Thomas Jefferson

So we come to the lot of dairy farmer believer: http://www.burlingtonfreepress.com/article/20110414/NEWS02/110413042/0/NEWS0213/Some-farmers-unhappy-Dean-Foods-settlement?odyssey=nav|headhttp://www.blogger.com/img/blank.gif

A quote from the article:

Obviously those farmer cannot remember before Suiza/Dean came on the scene and bonuses were actually paid.

There is a case in the Southeast where there was a hearing on January 20, 2011. On page 90 of the transcript: "NEXT WE COME TO PROMISE OF PREFERENTIAL PRICES. THESE ARE CONTEMPORANEOUS NOTES OF A 1998 ENGLES-HANMAN MEETING WHICH SHOWS THAT DFA AGREED TO USE CREDITS AND REBATES TO HELP SUIZA EXPAND. GARY HANMAN WROTE, QUOTE,NEED ACCESS TO MARKET, WILLING TO PRICE MILK SO YOU CAN BE COMPETITIVE, CAN GIVE CREDITS INTO AREAS AS YOU EXPAND,END QUOTE"

The Howrey law firm has invested $15 - 20 million in the southeast case and have box after box of discovery material.

On page 91 of the transcript: "SUIZA'S PLAN, I'M ON SLIDE 20, WAS HATCHED DURING A HUNTING TRIP HOSTED BY HANMAN, AND ATTENDED BY MR. ENGLES, MR. HANMAN, MR. BOS, MR. SCHENKEL, HOWARD DEAN AND SOME OTHER PEOPLE. OLD DEAN HAD A PRICE ADVANTAGES OVER BOTH SUIZA AND DFA IN BOTTLING BECAUSE OLD DEAN PROCURED LESS EXPENSIVE MILK FROM INDEPENDENT FARMERS. OLD DEAN HAD A PRICE ADVANTAGE OVER DFA IN MILK PROCUREMENT BECAUSE, BY ELIMINATING THE MIDDLEMAN, DFA, OLD DEAN PAID ITS INDEPENDENT FARMERS MORE THAN DFA PAID

ITS MEMBERS."

On page 118 of the transcript: "HANMAN ALSO HAD A MULTI-MILLION DOLLAR BONUS BASED ON INCREASES IN VALUE OR RETURNS ON EQUITY ON SUIZA/DEAN'S BOTTLING PLANTS AND DFA'S JOINT

VENTURE BOTTLING AFFILIATE DURING THE 1998-2004 PERIOD. MR. HANMAN RECEIVED NO BONUSES BASED ON INCREASING MILK PRICES. THE WHOLE POINT OF DFA IS TO GET THE BEST PRICES

FOR THEIR FARMERS. NONE OF HIS BONUSES WERE BASED ON THAT, THEY WERE BASED ON OTHER THINGS THAT MOTIVATED HIS ACTION."

While some DFA/DMS farmers may well believe they are getting the best possible deal now, the facts do not support that conclusion.

DFA is very good at managing herd behavior.

So we come to the lot of dairy farmer believer: http://www.burlingtonfreepress.com/article/20110414/NEWS02/110413042/0/NEWS0213/Some-farmers-unhappy-Dean-Foods-settlement?odyssey=nav|headhttp://www.blogger.com/img/blank.gif

A quote from the article:

Yet Friday morning, as many as two dozen dairy farmers will converge on federal court in Burlington to show their objection to the Dean Foods settlement, saying it could put them out of business. These farmers say the settlement, far from restoring competition, would enable Dean Foods to start dictating even lower milk prices.

Obviously those farmer cannot remember before Suiza/Dean came on the scene and bonuses were actually paid.

There is a case in the Southeast where there was a hearing on January 20, 2011. On page 90 of the transcript: "NEXT WE COME TO PROMISE OF PREFERENTIAL PRICES. THESE ARE CONTEMPORANEOUS NOTES OF A 1998 ENGLES-HANMAN MEETING WHICH SHOWS THAT DFA AGREED TO USE CREDITS AND REBATES TO HELP SUIZA EXPAND. GARY HANMAN WROTE, QUOTE,NEED ACCESS TO MARKET, WILLING TO PRICE MILK SO YOU CAN BE COMPETITIVE, CAN GIVE CREDITS INTO AREAS AS YOU EXPAND,END QUOTE"

The Howrey law firm has invested $15 - 20 million in the southeast case and have box after box of discovery material.

On page 91 of the transcript: "SUIZA'S PLAN, I'M ON SLIDE 20, WAS HATCHED DURING A HUNTING TRIP HOSTED BY HANMAN, AND ATTENDED BY MR. ENGLES, MR. HANMAN, MR. BOS, MR. SCHENKEL, HOWARD DEAN AND SOME OTHER PEOPLE. OLD DEAN HAD A PRICE ADVANTAGES OVER BOTH SUIZA AND DFA IN BOTTLING BECAUSE OLD DEAN PROCURED LESS EXPENSIVE MILK FROM INDEPENDENT FARMERS. OLD DEAN HAD A PRICE ADVANTAGE OVER DFA IN MILK PROCUREMENT BECAUSE, BY ELIMINATING THE MIDDLEMAN, DFA, OLD DEAN PAID ITS INDEPENDENT FARMERS MORE THAN DFA PAID

ITS MEMBERS."

On page 118 of the transcript: "HANMAN ALSO HAD A MULTI-MILLION DOLLAR BONUS BASED ON INCREASES IN VALUE OR RETURNS ON EQUITY ON SUIZA/DEAN'S BOTTLING PLANTS AND DFA'S JOINT

VENTURE BOTTLING AFFILIATE DURING THE 1998-2004 PERIOD. MR. HANMAN RECEIVED NO BONUSES BASED ON INCREASING MILK PRICES. THE WHOLE POINT OF DFA IS TO GET THE BEST PRICES

FOR THEIR FARMERS. NONE OF HIS BONUSES WERE BASED ON THAT, THEY WERE BASED ON OTHER THINGS THAT MOTIVATED HIS ACTION."

While some DFA/DMS farmers may well believe they are getting the best possible deal now, the facts do not support that conclusion.

DFA is very good at managing herd behavior.

Wednesday, April 13, 2011

Dairy Lobby Money

(click on image to enlarge)

The above list is depressing because, there is no one on the list which for certain has the best interest of the dairy farmer at heart.

With the exception of Dairylea, all the co-ops own processing plants and have an interest in maintaining low milk prices.

Dairylea is the so-called partner with DFA in Dairy Marketing Service (DMS). Essentially DMS is DFA and the point seems to be to obtain full supply agreements which increases DFA's market power, while vastly reducing premiums.

The fact that the government lets the shenanigans go unabated probably relates to the list above. The data source for the list is "Open Secrets."

Tuesday, April 12, 2011

Who is minding the store?

Certainly the FDA is responsible for upholding "standards of identity" for dairy products. But, they seem to not care or think what ever the big guys want to do, is OK.

Here is a link to an article on yogurt I did for the latest Milkweed:

http://themilkweed.com/Feature_11_Apr.pdfhttp://www.blogger.com/img/blank.gif

Compare FDA's efforts to stop "cow share" programs or raw milk sales with their enforcement effort on dairy standards.

Here is a link to an article on yogurt I did for the latest Milkweed:

http://themilkweed.com/Feature_11_Apr.pdfhttp://www.blogger.com/img/blank.gif

Compare FDA's efforts to stop "cow share" programs or raw milk sales with their enforcement effort on dairy standards.

Monday, April 11, 2011

World Commodity Outlook

The Reserve Bank of New Zealand has released an economic outlook: http://www.rbnz.govt.nz/research/econresearch/4363112.htmlhttp://www.blogger.com/img/blank.gif

The summary states:

The last paragraph is most interesting.

The summary states:

This paper interprets recent events and thinking in commodity markets and evaluates what these mean for New Zealand and monetary policy.

We conclude demand is underpinning commodity prices, creating a structural shift in the terms of trade of commodity exporters like New Zealand. Against this backdrop, idiosyncratic events such as weather-related crop failures and changes to government policies have pushed prices to historical highs. Supply responses will be relatively slow, implying prices are likely to stay high over the short to medium term, if a little lower than current levels.

New Zealand’s agricultural export prices are likely to remain at elevated levels for some time. Demand is underpinned by urbanisation and wealth growth in developing countries, especially China. However, there is potential for near term price falls as supply becomes less weather disrupted.

The appropriate monetary policy response will focus on the inflationary pressure that arises, not the terms of trade shift in itself. Higher terms of trade will contribute to appreciation of the exchange rate, facilitating the necessary adjustment in the real exchange rate via the nominal exchange rate rather than via rising inflation.

Medium term inflation remains the Bank’s focus. The Bank needs to be cautious that a terms of trade increase does not lead to increases in inflation expectations. For example, households and firms might use the income boost from higher commodity prices and exchange rates to bring forward consumption and investment, or increase borrowing. Consequent pressure on resources within New Zealand would lead to more inflationary pressure and monetary policy would counteract any rise in inflation expectations.

However, large uncertainties surround the outlook and underlying drivers for prices. One thing we do know is that the outlook will remain uncertain. History shows it is fiendishly difficult to predict the future path of commodity prices.

The last paragraph is most interesting.

Sunday, April 10, 2011

Free Markets?

(click on image to enlarge)

The Economist magazine has an interesting chart (see above): http://www.economist.com/blogs/dailychart/2011/04/public_opinion_capitalism

People in China are considerably more enthusiastic about the "free market" than people in the USA. I suspect there are two problems here. First, I don't think people in this country, while having opinions, have much understanding about the term.

Some Americans think it is getting the government out of everything. Do they mean highways, schools and the Post Office?

China, while claiming free markets, is really about letting individuals fail. It is definitely not that the government has gotten out of business. All land, all land in China is owned by the government. Probably those asked in China were urban and think that what they have now is better than rural poverty.

People in the U.S. know that their children will not be doing better than they are. This is a first for America.

So, it probably relates in most countries to time. Just exactly what the question was might also be important is a second aspect.

Throwing the word "free" into the mix is also a problem. While we think we believe very much in freedom, most people in this country spend most of their day working working for a large corporation. That boils down to dong what you are told.

No freedom is absolute. No one can drive down a highway at 120 MPH legally. So, as the late philosopher Sir Isaiah Berlin said, it is important to ask, "by whom am I coerced and to what end"?

Freedom is not a commodity, even though many think they own freedom. Milk should not be a commodity either, it is food.

Saturday, April 9, 2011

Price Takers?

(click on image to enlarge)

http://www.google.com/url?sa=X&q=http://www.stuff.co.nz/waikato-times/news/4867659/Farmers-hit-back-at-suggestions-of-milk-rip-off&ct=ga&cad=CAEQAhgAIAAoATACOAJAna6A7QRIAVAAWABiAmVu&cd=BSPu7ZU_tvc&usg=AFQjCNGM4JFxd1VYa2e0xQlq9MPP83f3rw

"Consumers see Fonterra as the big evil but we're a price taker, we're not a price setter. The prices they see are dictated by what other countries have said they will pay for it. People don't want to hear that though," Mr Houghton says. ..."

(more at link)

Maybe Mr. Houghton is right, but, that is not to say Fonterra has no power.

One question which no one seems to ask is why NFDM is traded on the CME? In some years, although prices have risen and fallen for NFDM on the CME, no actual product has changed hands. An example of the year in which no product changed hands is 2006. In 2007 one load was traded.

Obviously, the world price is being determined by the CME even though no one thinks of going to the CME to buy NFDM.

The California NFDM price, in 2010 averaged about 10 cents less than the CME for 2010. California is where most of the milk powder exported from the U.S. originates. Fonterra handled most of the exports from California in 2010.

So, one might say, Fonterra has friends in the right places. American dairy farmers cannot say the same.

Friday, April 8, 2011

Maybe Better Than We Deserve?

http://primary.washingtonpost.com/politics/27percent-of-communication-by-members-of-congress-is-taunting-professor-concludes/2011/04/06/AF1no2qC_story.html?wpisrc=nl_fedinsiderhttp://www.blogger.com/img/blank.gif

The headline reads: 27% of communication by members of Congress is taunting, professor concludes

Things are not good in D.C. But, 38% of native born Americans could not pass the test for citizenship.

We move closer to either brinksmanship or, maybe, showmanship. The FMMO offices will be open if the government shuts down because the money to operate the FMMOs comes from the milk pool money. However, NASS will not be collecting data.

The headline reads: 27% of communication by members of Congress is taunting, professor concludes

Things are not good in D.C. But, 38% of native born Americans could not pass the test for citizenship.

We move closer to either brinksmanship or, maybe, showmanship. The FMMO offices will be open if the government shuts down because the money to operate the FMMOs comes from the milk pool money. However, NASS will not be collecting data.

Thursday, April 7, 2011

We hold these truths to be self-evident, that all men are created equal

(click on image to enlarge)

When Thomas Jefferson wrote the words in the title of this post, America was far from equal. We nevertheless believe we live in some kind of meritocracy where just deserts are doled out.

While dairy farmers chip in their $.15 per hundredweight checkoff money to get people to buy more dairy products, it is obvious from the above graph that those most capable of spending more are actually buying more dairy products.

So, why not use the millions of checkoff dollars to enable the bottom 20% of income earners to bring home more from the dairy section?

The distribution of wealth in this country is right up there with the banana republics. Popular opinion however, seems to hold that those on the bottom deserve less and who knows maybe all the rest will soon be above average, maybe even filthy rich.

Wednesday, April 6, 2011

Creative Destruction

http://en.wikipedia.org/wiki/Joseph_Schumpeter

"Joseph Alois Schumpeter (8 February 1883 – 8 January 1950) was an Austrian-American economist and political scientist. He popularized the term "creative destruction" in economics."

For many years the concept when applied to dairy farms, meant driving the smaller family farm out of business to make room for the larger more "efficient" operations. The problem with most conventional economic thinking is a kind of mindlessness which sees humans and human communities as nothing more than cogs in a gear.

The truth is,and always shall be, "No man is an island, no man stands alone." That is to say, we will not make progress in dairy policy until we recognize the importance of the community in which dairy farms operate.

"Joseph Alois Schumpeter (8 February 1883 – 8 January 1950) was an Austrian-American economist and political scientist. He popularized the term "creative destruction" in economics."

For many years the concept when applied to dairy farms, meant driving the smaller family farm out of business to make room for the larger more "efficient" operations. The problem with most conventional economic thinking is a kind of mindlessness which sees humans and human communities as nothing more than cogs in a gear.

The truth is,and always shall be, "No man is an island, no man stands alone." That is to say, we will not make progress in dairy policy until we recognize the importance of the community in which dairy farms operate.

Tuesday, April 5, 2011

Elevator Music

Elevator music is that horrible noise while the elevator moves up or down. Right now the CME elevator is headed down, or so it seems. Stick around and it will go back up sooner or later.

Rabo Bank is considered to have pretty good information. Here is what Rabo recently said about the dairy situation:

I think the point of elevator music is to numb your mind while you are trapped in a little box going up and down. There will be the usual chorus, humming a familiar tune to explain all you need to do is lock in some prices of something or other.

Rabo Bank is considered to have pretty good information. Here is what Rabo recently said about the dairy situation:

We therefore conclude that, while sentiment may play a dominant role in setting market direction through the balance of March and into early April, market fundamentals will reassert themselves and continue to provide strong support for prices,which will likely trade at close to the levels evident in mid March in international markets as we progress through Q2.

I think the point of elevator music is to numb your mind while you are trapped in a little box going up and down. There will be the usual chorus, humming a familiar tune to explain all you need to do is lock in some prices of something or other.

Monday, April 4, 2011

Dairy Imports From China

Several recent stories have appeared regarding China's closing of dairy plants.

http://www.businessweek.com/ap/financialnews/D9MBDDKG2.htm

(more at link)

Some think we do not import dairy proteins from China, which is not true. While we may not import HTS Chapter 04 dairy proteins from China, we do import varying amounts of chapter 35 dairy proteins from China. In January of this year we imported 95 metric tons. Who can say where it went?

http://www.businessweek.com/ap/financialnews/D9MBDDKG2.htm

Government regulators say nearly half of all dairies in China are being denied new licenses and shut down after failing inspections to clean up the scandal-plagued dairy industry.

The quality inspection agency said Saturday that 533 of the country's 1,176 dairy producers have been ordered to cease operations. The agency says some 107 of them will have a chance to apply anew for licenses once they improve their quality controls.

(more at link)

Some think we do not import dairy proteins from China, which is not true. While we may not import HTS Chapter 04 dairy proteins from China, we do import varying amounts of chapter 35 dairy proteins from China. In January of this year we imported 95 metric tons. Who can say where it went?

Sunday, April 3, 2011

Recent Surge in Global Commodity Prices

While most of the news from Japan is about the earthquake and related events, there is a recent interesting report from the Bank of Japan:

http://www.boj.or.jp/en/research/wps_rev/rev_2011/rev11e02.htm/

Impact of financialization of commodities

In this country the groundwork was laid by former senator Phil Gramm who led the charge for deregulation. Of particular interest is the Commodity Futures Modernization Act of 2000 which allowed hedge funds to trade agricultural commodities.

More than ethanol, the money traders have driven up costs for dairy farmers.

http://www.boj.or.jp/en/research/wps_rev/rev_2011/rev11e02.htm/

Impact of financialization of commodities

Global commodity prices have been rising again since 2009, and particularly rapidly since the fall of 2010. While the strong increase in commodity prices has been driven by global economic growth propelled by emerging economies, speculative investment flows into commodity markets have amplified the intensity of the price surge. The dynamics of global commodity prices has been changing as well, in accordance with the growing presence of financial investors in commodity markets. The entry of new financial investors has paved the way for the "financialization of commodities". Consequently, global commodity markets have become more sensitive to portfolio rebalancing by financial investors, which has made commodity markets more correlated with other asset markets, including major equity markets. Furthermore, globally accommodative monetary conditions have played an important role in the surge in commodity prices, both by stimulating physical demand for commodities and driving more investment flows into financialized commodity markets.

In this country the groundwork was laid by former senator Phil Gramm who led the charge for deregulation. Of particular interest is the Commodity Futures Modernization Act of 2000 which allowed hedge funds to trade agricultural commodities.

More than ethanol, the money traders have driven up costs for dairy farmers.

Saturday, April 2, 2011

IDFA PR Release

International Dairy Foods Association (IDFA) has released a thinly disguised salvo over the bow of National Milk Producers Federation (NMPF)and its Foundation For The Future (FFTF).

http://www.prnewswire.com/news-releases/idfa-advocates-funding-for-usda-risk-management-insurance-program-119076749.html

Asks Ag Committee Chairs to Fund Program for Balance of 2011

Expresses opposition to so-called "Growth Management Programs"

NMPF, meanwhile is asking for people to sign on to its FFTF and they will let you know the details later

http://www.prnewswire.com/news-releases/idfa-advocates-funding-for-usda-risk-management-insurance-program-119076749.html

Asks Ag Committee Chairs to Fund Program for Balance of 2011

Expresses opposition to so-called "Growth Management Programs"

WASHINGTON, April 1, 2011 /PRNewswire-USNewswire/ -- Connie Tipton, CEO of the International Dairy Foods Association, has called on Congress to maintain funding for a federal risk management insurance program for dairy farmers. In a letter to U.S. Sen. Debbie Stabenow (D-MI), chairwoman of the Senate Committee on Agriculture, and U.S. Sen. Pat Roberts (R-KS), ranking member of the committee, Tipton restated IDFA's opposition to any government program that would attempt to control milk price volatility, but affirmed support for the Livestock Gross Margin-Dairy program. Tipton pointed out the program's increased relevance, with more than 1400 contracts issued in FY 2011. Tipton cautioned that USDA has nearly reached its underwriting capacity for the program, and urged the senators to fund the program for the remainder of the year.

"Expanding this program is something that can be done now to help our nation's dairy farmers," wrote Tipton. "There is strong support among both producers and processors for the LGM-Dairy program. As it now stands, the program has insured about 2.4% of the U.S. milk production. Providing additional funding would make it available to more producers who may be just learning about the program for the first time."

The Livestock Gross Margin insurance policy provides protection against the loss of gross margin (market value of milk minus feed costs) on the milk produced from dairy cows. The LGM for Dairy Cattle insurance policy uses futures prices for corn, soybean meal, and milk to determine the expected gross margin and the actual gross margin. IDFA has consistently advocated for a safety net for dairy farmers, including margin insurance like that offered through the LGM-Dairy program.

"While we understand current budget pressures, we urge you to consider funding the LGM-Dairy program for the remainder of this year so that our nation's dairy farmers can be provided the tools available to others in production agriculture," Tipton wrote.

For more information on supply controls, and for the full content of the letter, please visit www.keepdairystrong.com.

NMPF, meanwhile is asking for people to sign on to its FFTF and they will let you know the details later

Friday, April 1, 2011

Political Frustration

The number of times good decent dairy farmers think all that is necessary for change is a trip to Washington, D.C. where some eager representative of the people will listen to the "real" story and presto fix the problem cannot be counted.

As most learn, the task is more daunting. Martin Gilens, a researcher at Princeton University has assembled some shocking data.

http://www.princeton.edu/~mgilens/research.html

Inequality and Democratic Accountability

Gilens concludes his research with:

The fact is Americans cannot simply give up on government, but, efforts to get behind some "silver bullet" piece of legislation must be judged under a strong light of reality. There is only so much energy left in the dairy community. That energy should not be spent spinning wheels.

As most learn, the task is more daunting. Martin Gilens, a researcher at Princeton University has assembled some shocking data.

http://www.princeton.edu/~mgilens/research.html

Inequality and Democratic Accountability

The ability of citizens to influence government policy is at the heart of democracy. But citizens are quite unequal in their ability to shape government policy to their liking. In this project I examine the association between what Americans say they want the federal government to do (based on national surveys) and what government does (based on detailed coding of public policy). I find a moderately strong relationship between public preferences and public policy, albeit with a strong bias toward the status quo. But I also find that when Americans with different income levels differ in their policy preferences, actual policy outcomes strongly reflect the preferences of the most affluent but bear virtually no relationship to the preferences of poor or middle income Americans. This vast discrepancy in government responsiveness to citizens with different incomes stands in stark contrast to the ideal of political equality that Americans hold dear. Although perfect political equality is an unrealistic goal, representational biases of this magnitude call into question the very democratic character of our society. I am currently working on a book manuscript based on this project.

Gilens concludes his research with:

There has never been a democratic society in which the citizens' influence over government policy was unrelated to their financial resources. In this sense, the difference between democracy and plutocracy is one of degree. But by the same token, a government that is democratic in form but is in practice only responsive to its most affluent citizens is a democracy in name only.

Most middle-income Americans think that public officials do not care much about the preferences of "people like me." Sadly, the results presented above suggest that they may be right. Whether or not elected officials and other decision-makers "care" about middle-class Americans," influence over actual policy outcomes appear to be reserved almost exclusively for those at the top of the income distribution.

The fact is Americans cannot simply give up on government, but, efforts to get behind some "silver bullet" piece of legislation must be judged under a strong light of reality. There is only so much energy left in the dairy community. That energy should not be spent spinning wheels.

Thursday, March 31, 2011

Entrepreneurship

http://www.blogger.com/img/blank.gif

(click on image to enlarge)

After WW II there was a massive amount of people who needed employment. The GI Bill provided many opportunities, including farm loans. So, many people went into farming, including dairy farming, a form of entrepreneurship.

There is a new report out from the Cleveland Federal Reserve Office: http://www.clevelandfed.org/research/commentary/2011/2011-04.cfm

Between December 2007 and June 2009, the United States suffered its biggest economic downturn since the Great Depression. Dubbed the Great Recession, this economic contraction saw gross domestic product decline 4 percent and the unemployment rate more than double from 4.9 percent to 10.1 percent.

While the media was full of reports about how the recession affected big business and consumers, it was largely silent on what happened to entrepreneurship. Economists are divided on the matter.

Some believe that recessions have no effect on entrepreneurial activity, arguing that the negative effects of reduced demand are offset by the increased motivation to have one’s own business as a protection against layoffs.

Others believe that the Great Recession actually brought about an upswing in entrepreneurship, as the downturn pushed laid-off workers to pursue their entrepreneurial dreams. A press release announcing a recent report from the Ewing Marion Kauffman Foundation, for example, went so far as to argue, “Rather than making history for its deep recession and record unemployment, 2009 might instead be remembered as the year business startups reached their highest level in 14 years—even exceeding the number of startups during the peak 1999–2000 technology boom.”

Unfortunately, a careful look at the data suggests otherwise. Multiple sources of government and private data show that the Great Recession was actually a time of considerable decline in entrepreneurial activity in the United States.

(full report at link)

The report concludes, "By most available measures, the Great Recession’s effect on entrepreneurship was negative."

Although the report offers no explanations, it would seem to be obvious that the climate favored big over small businesses.

Wednesday, March 30, 2011

Agricultural Prices

http://www.blogger.com/img/blank.gif

http://www.blogger.com/img/blank.gif(click on image to enlarge)

Today, March 30, 2011 USDA published its "Agricultural Prices" report: http://usda.mannlib.cornell.edu/usda/current/AgriPric/AgriPric-03-30-2011.pdf

Above is the all milk price for most states. Note, there appears to be quite a spread in butter fat test. California is mostly giving milk away. Note also, the hay prices on page 23. these seem to be lower than many reports but, California is not getting free hay.

On page 30 note, the "All Milk Price" for March 2011 is 46% of parity. Some say dairy farmers have received a signal to produce more milk, the signal never goes away.

Tuesday, March 29, 2011

Somewhat Less Than Exciting News

(click on images to enlarge)

Today Dean Foods settled with the U.S. Department of Justice and State AG's regarding Dean Foods' purchase of Foremost Farms fluid milk plants.

Just who might be willing to purchase the plant is a riddle. Between the likes of Dean and Wal*Mart, there is not a lot of profit in fluid milk.

Monday, March 28, 2011

World Butter Trade

e

e (Click on image to enlarge)

Looking at the graph above could be misleading. While it is true world trade of butter has fallen, the U.S. export volume has grown. In 2009 the U.S exported 22,827 metric tons of actual butter (HTS 040510). In 2010, the U.S. exported 45,557 tons. In January of 2011, there was an increase of 35.4% in butter exports.

The lesson here is most legislation regarding dairy will have world trade and globalism leading the way. This will not necessarily be a winning ticket for U.S. dairy farmers.

Sunday, March 27, 2011

Dire Warning

(click on image to enlarge)

Word from New Zealand about future dairy price seems grim: http://www.stuff.co.nz/business/4814594/Futures-point-to-dairy-price-sag

"New Zealand's run of strong dairy prices could be ending with the price of contracts on the NZX's Dairy Futures market sagging as 2011 progresses.

Releasing its half-year results this past week, Fonterra announced 2011 was shaping up as one of the best ever in terms of returns to its farmer shareholders.

However, prices on the NZX's new futures market, which is starting to see solid growth in trading, ebbs from $US4205 ($5600) for contracts maturing in March to $US3885 from October onwards, a drop of nearly 8%."

(more at link)

So, what is NZX's "Dairy Futures" market: http://www.nzx.com/about-nzx/4224534/NZX-Dairy-Futures-record-first-trade

"NZX Dairy Futures traded for the first time today. Ten lots of the October 2010 Global Whole Milk Powder future traded at US$3,525/t. NZX Dairy Futures launched on 8 October.

During the first two days of operation there were up to 30 lots on offer in each of the front seven expiry months, which represented 210 lots total volume on offer with a US$792,000 notional value.

“We're confident that demand for NZX Dairy Futures will continue to build, and we look forward to welcoming additional participants to the market in the near term,” said NZX Head of Markets Fiona Mackenzie.

The NZX Dairy Futures market is an anonymous market and the firms making individual trades are not disclosed."

NZX has gone from 10 trades in October 2010 to 20 trades in February 2011 - pretty exciting (see above). OK 20 trades in February but, no indication as to the number of traders? Maybe there are five traders or maybe ten or maybe just the ruler of Oz.

We do need to firm up the meaning of market because at this point it seems to be just the will of those with power.

Saturday, March 26, 2011

Ethanol Futures

(click on image to enlarge)

Here is a story from Bloomberg on ethanol futures: http://www.bloomberg.com/news/2011-03-25/ethanol-futures-decline-as-corn-falls-on-global-demand-concern.html

The March 25, 2011 article begins:

Ethanol futures declined in Chicago as corn dropped on concern global demand for the grain may wane.

The grain-based additive followed corn lower on speculation consumption from Japan could suffer as the country battled to avoid a meltdown at its Fukushima plant and as unrest swept across the Middle East and Africa. Ethanol is made from corn in the U.S.

“Ethanol was hampered by the volatility in corn, particularly in the physical markets, with both sides of the market unable to stick to numbers as prices whipped around,” analysts at SCB & Associates LLC wrote in a note to clients.

Look above at the Commodity Futures Trading commission (CFTC) "Commitment of Traders" (COT)report has to say. Talk about a thin market? One can only infer those traders have a lot of pull in Washington D.C.

Friday, March 25, 2011

Food Costs

USDA ERS has released projections on the rise of food costs: http://www.bloomberg.com/news/2011-03-25/usda-retail-food-inflation-forecasts-for-2011-text-.html

The article begins:

(full text at link above)

There really is another important aspect to food costs which is rarely discussed. Writers tend to point out how food costs to Americans is less than 10% of income. Averages hide a lot of essential details.

If you divide incomes into 5 groups (quintiles)and then look at the data, the richest 20% spend about 4% of their income on energy and another 4% on food. For the bottom 20%, the picture is quite different. The poor spend 20.6% of their income on energy and a total of 23.5% on food.

To make matters worse, the poor buy from the middle of the store where all the carbs and filler foods are on display. Then there is the problem of further obesity.

There was a time when the poor, particularly the rural poor, could cook good meals from a few cheap ingredients, such as dry beans. But, cooking takes time and the working poor are working too many hours to spend a lot of time in food preparation.

We are becoming more of a two class nation and failing to examine underlying causes.

The article begins:

Following is the text detailing forecasts for percentage changes in annual food prices, according to the U.S. Department of Agriculture:

Food Price Outlook, 2011

In 2011, the Consumer Price Index (CPI) for all food is projected to increase 3 to 4 percent. Food-at-home (grocery store) prices are forecast to rise 3.5 to 4.5 percent, while food-away-from-home (restaurant) prices are forecast to increase 3 to 4 percent. Although food price inflation was relatively weak for most of 2009 and 2010, cost pressures on wholesale and retail food prices due to higher energy and food commodity prices, along with strengthening global food demand, have pushed inflation projections for 2011 upward.

(full text at link above)

There really is another important aspect to food costs which is rarely discussed. Writers tend to point out how food costs to Americans is less than 10% of income. Averages hide a lot of essential details.

If you divide incomes into 5 groups (quintiles)and then look at the data, the richest 20% spend about 4% of their income on energy and another 4% on food. For the bottom 20%, the picture is quite different. The poor spend 20.6% of their income on energy and a total of 23.5% on food.

To make matters worse, the poor buy from the middle of the store where all the carbs and filler foods are on display. Then there is the problem of further obesity.

There was a time when the poor, particularly the rural poor, could cook good meals from a few cheap ingredients, such as dry beans. But, cooking takes time and the working poor are working too many hours to spend a lot of time in food preparation.

We are becoming more of a two class nation and failing to examine underlying causes.

Thursday, March 24, 2011

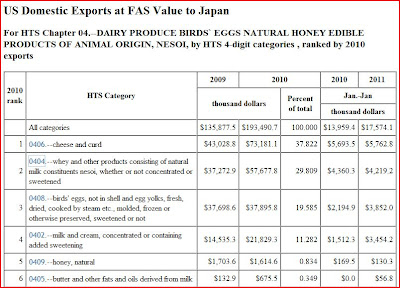

Dairy Boat to Japan

(click on image to enlarge)

As noted in the last post, we import no dairy products from Japan. The boat going the other way is a different story, as seen above.

The above table shows dollar values, which makes exports of cheese appear much larger than exports of whey. Japan is a very large customer of whey products from the U.S. The total volume is more than twice the volume of cheese.

Japan is understood to be actively looking to more dairy products.

Wednesday, March 23, 2011

SAFE

(click on image to enlarge)

While it makes good news to say we have cut off dairy imports from Japan, it all amounts to saying we have done something, when in fact, we have done nothing.

How Milk is Priced?

http://www.3news.co.nz/Fonterra-rejects-calls-for-inquiry-into-milk-prices/tabid/421/articleID/203714/Default.aspx

Fonterra, oddly enough, is claiming they have nothing to do with milk - it is the "market." Sound familiar?

(complete story at link)

Here in the USA:

http://www.fsa.usda.gov/FSA/webapp?area=about&subject=landing&topic=dia

Aside from providing a cure for insomniacs, what was accomplished?

Pay no attention to the guy behind the curtain.

Fonterra, oddly enough, is claiming they have nothing to do with milk - it is the "market." Sound familiar?

Fonterra is rejecting calls for an inquiry into how milk prices are set.

The company says prices are set as part of a normal commercial process and that New Zealanders have to get used to being part of the global market.

(complete story at link)

Here in the USA:

http://www.fsa.usda.gov/FSA/webapp?area=about&subject=landing&topic=dia

The purpose of the Dairy Industry Advisory Committee is to review the issues of farm milk price volatility and dairy farmer profitability and provide a report with recommendations to the secretary on how USDA can best address these issues to meet the dairy industry’s needs in the near and long term. The report also will provide feedback on the effectiveness of recent actions taken by USDA affecting the dairy industry. USDA’s Dairy Industry Advisory Committee brings the concerned public into a productive, information-gathering process to assist in developing recommendations for the development of national dairy industry and trade policies.

Aside from providing a cure for insomniacs, what was accomplished?

Pay no attention to the guy behind the curtain.

Subscribe to:

Posts (Atom)