Today, USDA release its Ag Prices report available at: http://usda.mannlib.cornell.edu/usda/current/AgriPric/AgriPric-01-31-2011.pdf

USDA estimated the "All Milk" price at $16.20/cwt. USDA also states the parity price would have been $44/cwt (that is at over 90% parity, which never happened). Nevertheless, there ha been a lot of money going into the middle since Reagan signed the bill eliminating parity milk pricing.

A thorough examination of where the money went would be useful in many ways. Is the entire system efficient, or is it just capturing a benefit of a form of servatude?

For those who are interested, the above link has a great deal of information on parity and how it is calculated.

Monday, January 31, 2011

Sunday, January 30, 2011

Import Milk - Hardly

(click on image to enlarge)

The above table is from USDA FAS PS&D and is in 1,000 metric tons.

Many people believe, U.S. dairy farms will be "disappeared" and all milk will be imported. This is hardly possible. No other country could supply the U.S. with the necessary milk.

The attitude of policy makers make the false belief seem credible.

However, we do move milk distances which would seem like crossing several national borders. Hauling dairy products, butter for instances, from coast to coast is 5 1/2 time the distance from Berlin, Germany to Paris, France.

We also seem to be the balancing source for New Zealand's production, at our loss.

Saturday, January 29, 2011

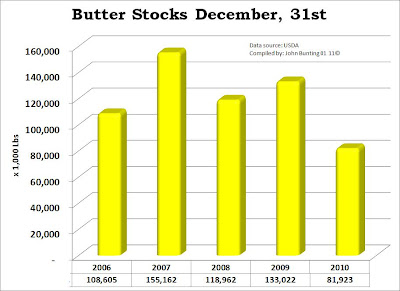

Butter Stocks

(click on image to enlarge)

At: http://www.nzherald.co.nz/agriculture/news/article.cfm?c_id=16&objectid=10702253

is, in part:

Tightening supplies have pushed global butter prices to their highest level in two decades, according to NZX Agrifax.(more at link)

The agricultural information provider says data from the United States Department of Agriculture show butter stocks - although increasing - are 38 per cent lower than a year ago.

Many feel butter prices will stay near current level for the foreseeable future. Hopefully, dairy farm milk price will rise and stay high enough for people to recover.

Friday, January 28, 2011

Plutocracy

(click on image to enlarge)

According to Wikipedia: "Plutocracy is rule by the wealthy, or power provided by wealth. The combination of both plutocracy and oligarchy is called plutarchy."

Wealth, generally, does not materialize from thin air. Emmanuel Saez of Berkly has assembled massive amounts of data about wealth using income tax data. In the so-called Bush expansion years (2002 - 2007) the top 1% captured 65% of real income growth.

Since consumers continue to pay more each year for food,the spread between the net farm income and the consumer is going somewhere and it is not going to the working poor.

As farm milk prices rise, the question is how much will remain on the farm and how much will be siphoned off? Part of the puzzle lies in who has the biggest voice in government.

Thursday, January 27, 2011

USDA ERS Food Price Projections

USDA's Economic Research Service has recently released its latest projection s on food prices for 2011. The report: http://www.ers.usda.gov/briefing/cpifoodandexpenditures/consumerpriceindex.htm

states:

The data shows retail dairy prices to rise most dramatically. Get ready for the usual suspects to call for lower dairy farm milk prices.

states:

In 2011, the Consumer Price Index (CPI) for all food is projected to increase 2 to 3 percent. Both food-at-home (grocery store) and food-away-from-home (restaurant) prices are also forecast to increase 2 to 3 percent. Although food price inflation was relatively weak for most of 2009 and 2010, higher food commodity and energy prices have recently exerted pressure on wholesale and retail food prices. Hence, higher prices are projected to push inflation toward the historical average inflation rate of 2 to 3 percent in 2011.

The all-food CPI increased 0.8 percent between 2009 and 2010, the lowest food inflation rate since 1962. Food-at-home prices increased by 0.3 percent—the lowest annual increase since 1967—with cereal and bakery prices declining 0.8 percent and processed fruit and vegetable prices dropping 1.3 percent, while food-away-from-home prices rose 1.3 percent in 2010, the lowest annual increase for restaurant prices since 1955.

The data shows retail dairy prices to rise most dramatically. Get ready for the usual suspects to call for lower dairy farm milk prices.

Wednesday, January 26, 2011

Transfer of Funds

There is a recent National Bureau of Economic Research (NBER) paper:MODELING PROCESSOR MARKET POWER AND THE INCIDENCE OF AGRICULTURAL POLICY:A NON-PARAMETRIC APPROACH by Rachael E. Goodhue and Carlo Russo. The document is: Working Paper 16706

The paper is concerned with wheat, however, there are some interesting parallels to dairy. The authors state, "the wheat milling industry is relatively concentrated, while there are a very large number of wheat-producing farms. Consequently, individual farmers have relatively little ability to negotiate effectively.

These factors are reflected in the organization of farmgate grain markets;

generally prices are set by buyers and farmers choose whether or not to accept the take-it-orleave-it offer." Sounds like dairy.

The authors conclude:

If you substitute milk for wheat and throw in the MILC payment, there should have been no surprise 2009 was Dean Foods most profitable year.

The paper is concerned with wheat, however, there are some interesting parallels to dairy. The authors state, "the wheat milling industry is relatively concentrated, while there are a very large number of wheat-producing farms. Consequently, individual farmers have relatively little ability to negotiate effectively.

These factors are reflected in the organization of farmgate grain markets;

generally prices are set by buyers and farmers choose whether or not to accept the take-it-orleave-it offer." Sounds like dairy.

The authors conclude:

"This analysis demonstrates that market power might redistribute the benefits of government intervention. It provides empirical evidence that U.S. wheat millers were able to increase their marketing margins on average by approximately 10 percent when farmers received payments through a marketing loan program. This expected increase in margins was computed controlling for the realizations of a broad set of supply, demand and processor marginal costs shifters in those years. In turn, these findings suggest that millers are extracting a rent from the deficiency payment/marketing loan gain policy. Thus, the analysis suggests that the general assumption that competitive models may be a good approximation for imperfectly competitive agricultural markets does not necessarily hold, particularly if distribution, as well as efficiency, is a concern."

If you substitute milk for wheat and throw in the MILC payment, there should have been no surprise 2009 was Dean Foods most profitable year.

Tuesday, January 25, 2011

Systems Thinking

Right now prices are moving up and up in dairy trading on the CME. Generally, this means dairy farmers will go back to sleep but, this is the time to think about the dairy system.

The dairy system is more than just price. In the end, the only reason for government involvement is the public's interest. Thinking about the public's interest is tricky in the era of Wal*Mart shopper.

Cheap dairy products hauled all over the world might seem to be in the public's interest but, is it in a time of high oil prices?

We like to think that capitalism and our system is the best, however, in the entire history of the world there has never, ever been wealth generated as fast is presently occurring in China under communism. China is using the old idea of greed as if they invented the concept.

At some point, the question needs to be asked, what kind of people do we want to be?

The dairy system is more than just price. In the end, the only reason for government involvement is the public's interest. Thinking about the public's interest is tricky in the era of Wal*Mart shopper.

Cheap dairy products hauled all over the world might seem to be in the public's interest but, is it in a time of high oil prices?

We like to think that capitalism and our system is the best, however, in the entire history of the world there has never, ever been wealth generated as fast is presently occurring in China under communism. China is using the old idea of greed as if they invented the concept.

At some point, the question needs to be asked, what kind of people do we want to be?

Monday, January 24, 2011

Economic Models

(click on image to enlarge)

Conventional dairy experts are always digging in their bag of excuses to explain why dairy farmers are getting more for their milk. One example which only pops up from time to time, is the milk/feed ratio. "Normal" thinking holds that when the milk/feed ratio is above three, dairy farmers will expand. As can be seen in the above graph, this is nonsense.

Since most of the conventional experts are land-grant employees, that is public servants, there is an obligation to hold the economic models up to the light of day. This does not happen and one might wonder why?

Upton Sinclair wrote a muckraking novel on the meat packing industry in 1906. Sinclair said, " It is difficult to get a man to understand something, when his salary depends upon his not understanding it!"

Sunday, January 23, 2011

Promoting the Affluent

If you go to: http://www.dairyherdnetwork.com/NLA_Tue.aspx?oid=1300148&tid=Archive

You will find a a "PR Newswire" release from Domino's Pizza:

Then we find:

In other words, dairy farmers checkoff dollars are promoting Domono's Pizza because of the so-called cheese topping.

The so-called cheese is made by Leprino. Forbes magazine lists Jimmy Leprino as the 141st richest American in 2009. See:http://www.forbes.com/lists/2009/54/rich-list-09_James-Leprino_XMXS.html

Estimated sales, $2.6 billion.

Seems like Jimmy could afford to promote his own product without drawing money from dairy farmers.

You will find a a "PR Newswire" release from Domino's Pizza:

Domino's Pizza, the recognized world leader in pizza delivery, is striving to be a part of the solution when it comes to promoting healthy, active lifestyles for young people – highlighted by the launch of its Domino's Smart Slice school lunch pizza.

Domino's Smart Slice is a white whole-wheat, reduced fat and reduced sodium pizza, which is baked fresh and delivered to schools. Domino's Smart Slice is already being served in more than 120 school districts, and Domino's plans to double that number within the next year.

Then we find:

"Domino's Smart Slice is a fantastic example of industry collaborating with America's dairy producers to develop an innovative solution that nourishes children," said Tom Gallagher, Dairy Management, Inc. CEO.

"We have been conscious that pizza can be perceived as not healthy, and Domino's Smart Slice solves that problem," said Brent Craig, director of nutrition services in Douglas County, Colo., a participant school district. "Pizza is without a doubt our students' favorite food, and serving this gives us an option that is nutritious – not to mention, our students love it. It's a great win-win for us."

In other words, dairy farmers checkoff dollars are promoting Domono's Pizza because of the so-called cheese topping.

The so-called cheese is made by Leprino. Forbes magazine lists Jimmy Leprino as the 141st richest American in 2009. See:http://www.forbes.com/lists/2009/54/rich-list-09_James-Leprino_XMXS.html

Cheese king weathering recession: dairy prices have declined sharply during past year, enticing cash-strapped pizza lovers to indulge their cravings. Leprino Foods supplies cheese for budget-friendly fare like Domino?s, Papa John?s, Pizza Hut pizzas, Hot Pockets

Estimated sales, $2.6 billion.

Seems like Jimmy could afford to promote his own product without drawing money from dairy farmers.

Saturday, January 22, 2011

More on DFA's Opposition

DFA in documents file in Vermont Federal District Court on January 18, 2011 objected to the settlement with Dean Foods.

In a court document, Greg Wickham, general manager of DMS states:

DMS is not an "common marketing agency," in any usual sense of the term. It operates actually as a market allocating agency. There is quite a difference.

Wickham also states,"In addition, DMS and 2010 markets milk of hundreds of independent dairy farmers were not members of any cooperative," and fails to mention that many quite possibly most, are not voluntarily participating in the DMS system.

"In September 2010, for example, DMS marketed total of 1.272 billion pounds of raw milk, 1.166 billion pounds of which was marketed to plants in Order I” according to the court document. That volume represents 60% of Order I milk.

With all of that market share, Wickham complains:

What he is saying, is that Dean Foods has more market power than an organization,DMS, which by their own reckoning has 60% of the milk in Order I.

In a court document, Greg Wickham, general manager of DMS states:

“DMS is an LLC is also a common marketing agency that today markets milk for almost 8000 dairy farmers in the northeastern United States. DMS is owned by three cooperatives: Dairylea, DFA and St. Alban’s. Although DMS to is not directly have any farmer members, it is indirectly owned by the farmers who belonged to and own Dairylea, DFA and St. Albans and DMS's operations are overseen by a Board of Directors made up of dairy farmers from each of its owner coops. These three coops have all designated DMS as their exclusive marketing agent for raw milk in the northeastern United States. As of August 2010 they were about 1,441 Dairylea producers marketing milk through DMS in the Northeast, about 1,463 DFA producers and about 446 dairy farmers were members of St. Albans.”

DMS is not an "common marketing agency," in any usual sense of the term. It operates actually as a market allocating agency. There is quite a difference.

Wickham also states,"In addition, DMS and 2010 markets milk of hundreds of independent dairy farmers were not members of any cooperative," and fails to mention that many quite possibly most, are not voluntarily participating in the DMS system.

"In September 2010, for example, DMS marketed total of 1.272 billion pounds of raw milk, 1.166 billion pounds of which was marketed to plants in Order I” according to the court document. That volume represents 60% of Order I milk.

With all of that market share, Wickham complains:

"For example, there is one Dean planted which we primarily provide milk for class I purposes, and also ship about 10,000,000 pounds a month of milk that is used for class II purposes. With respect to that Class II milk, we have told Dean's repeatedly that we felt the milk was underpriced by over $1.00/cwt, but for years they were unwilling to give ground in the negotiations. Even with the recent price increase to that plant, it is in my view still underpriced by $40 - .50/cwt."

What he is saying, is that Dean Foods has more market power than an organization,DMS, which by their own reckoning has 60% of the milk in Order I.

Friday, January 21, 2011

DFA's Opposition to Dean Food Settlement

DFA's press releases on the proposed settlement of the NE case are everywhere (to coin a phrase - none dare call it journalism).

Career board member of DFA/DMS Ed Shoen states in a court document:

There is no doubt that DFA rules the roost in FMMO I and Dean Foods is the major Class I user. So, if you go to:

http://www.ams.usda.gov/AMSv1.0/getfile?dDocName=STELPRDC5081678

"Announced Cooperative Class I Price for Selected Cities"

You will find the price for FMMO I is 59% of the average and less than half of nearby orders.

Con games always sound so logical.

Career board member of DFA/DMS Ed Shoen states in a court document:

When Dean uses this provision to say that the “competitive market price” for

the milk it buys under Section 9.2 is lower than what DMS had been charging, then I’m sure Dean will then want DMS to cut the price on the rest of the milk DMS is selling to Dean so that it too is sold at that lower “competitive market price” that Dean has announced. We’ll end up getting less for all of our milk sales to Dean, and we’ll be selling them less volume, but we’ll still

have the responsibility and cost of balancing their needs at the plants we serve. Under our current arrangements with Dean, one of the services we provide is “balancing” the plants’ needs no matter how supply and demand conditions change over the course of the year. It could be plus or minus 20-30 loads per plant from one day to another. That’s a valuable service and one that costs money to provide, whether it’s disposing of surplus milk or paying for additional milk when milk is short. When we lose this volume, I expect we’ll face the same balancing costs for Dean, but we’ll have less milk to recover those costs. The other possibility is for Dean to do its

own balancing which adds cost on their end for the “independent milk” they have just incurred. It might well have been less harmful to us if the Proposed Settlement gave away all of the volume at one plant, and at least saved us the balancing costs there.

There is no doubt that DFA rules the roost in FMMO I and Dean Foods is the major Class I user. So, if you go to:

http://www.ams.usda.gov/AMSv1.0/getfile?dDocName=STELPRDC5081678

"Announced Cooperative Class I Price for Selected Cities"

You will find the price for FMMO I is 59% of the average and less than half of nearby orders.

Con games always sound so logical.

Thursday, January 20, 2011

DFA & Northeast Settlement

DFA has launched a massive PR campaign regarding the settlement with Dean Foods in the Northeast case.

http://www.bizjournals.com/kansascity/news/2011/01/19/dairy-farmers-of-america-protests-30m.html

According to the article and the court "DFA claims that such an arrangement would cause price erosion for dairy farmers."

Really,the arraignment DFA has had with Dean allows Dean to pay no premiums. You really can't go much lower than FMMO minimums. No wait, yes you can if you reblend dairy farmers milk checks as DFA has commonly done in Missouri, where they are headquartered.

See the mail box prices: http://www.fmmaclev.com/MailBoxes/MAILBOX2009.pdf

http://www.bizjournals.com/kansascity/news/2011/01/19/dairy-farmers-of-america-protests-30m.html

According to the article and the court "DFA claims that such an arrangement would cause price erosion for dairy farmers."

Really,the arraignment DFA has had with Dean allows Dean to pay no premiums. You really can't go much lower than FMMO minimums. No wait, yes you can if you reblend dairy farmers milk checks as DFA has commonly done in Missouri, where they are headquartered.

See the mail box prices: http://www.fmmaclev.com/MailBoxes/MAILBOX2009.pdf

Wednesday, January 19, 2011

Milk Production Up _ What's New

Milk production for the country was up 2.5% in December:

http://usda.mannlib.cornell.edu/MannUsda/viewDocumentInfo.do?documentID=1103

Who knows what the figures actually are? But, dairy farmers have run up feed bills, let many bills go unpaid and eaten up years upon years of equity to continue to produce milk.

There are moral question to economic question which are being ignored.

http://usda.mannlib.cornell.edu/MannUsda/viewDocumentInfo.do?documentID=1103

Who knows what the figures actually are? But, dairy farmers have run up feed bills, let many bills go unpaid and eaten up years upon years of equity to continue to produce milk.

There are moral question to economic question which are being ignored.

Tuesday, January 18, 2011

Corn's Up

(click on image to enlarge)

The latest World Agricultural Supply Demand Estimates from USDA at at:

http://www.usda.gov/oce/commodity/wasde/latest.pdf

U.S. feed grain supplies for 2010/11 are projected down reflecting lower corn

production. U.S. corn production is estimated 93 million bushels lower as a 1.5-bushel-per-acre reduction in the national average yield outweighs a 183,000-acre increase in harvested area. A 5-million-bushel increase in projected U.S. corn imports slightly offsets the reduction in output. Corn

feed and residual use is projected 100 million bushels lower based on September-November disappearance as indicated by the December 1 stocks. Corn used for ethanol is raised 100 million bushels offsetting the reduction in expected feed and residual use. Record December ethanol production, as indicated by weekly Energy Information Administration data, boosts corn use to

date.

Ending corn stocks for 2010/11 are projected 87 million bushels lower at 745 million. This is down 963 million bushels from last year. The stocks-to-use ratio is projected at 5.5 percent, the lowest since 1995/96 when it dropped to 5.0 percent. The 2010/11 marketing-year average farm price projection is raised 10 cents on both ends of the range to $4.90 to $5.70 per bushel as cash and futures prices are expected to strengthen. Heavy early season marketings of corn priced well below current cash price levels are expected to limit the upside potential for the weighted average price received by producers.

This headline from Bloomberg:

Corn Climbs to 30-Month High on Rising Demand for Smaller Supply

January 18, 2011, 3:20 PM EST

available at: http://www.businessweek.com/news/2011-01-18/corn-climbs-to-30-month-high-on-rising-demand-for-smaller-supply.html

fails to mention ethanol.

Dairy farmers will not be feeding heavy for anytime in the foreseeable future.

Monday, January 17, 2011

Supply and Demand ... CME

(click on image to enlarge)

If you go to: http://www.agweb.com/livestock/dairy/blog/Dairy_Talk_199/

you will find most of the column is about margin insurance and just how great that is. Are you on the bandwagon or not?

My big problem really lies with one little part which will not go away:

But a more rational view (yes, admittedly, prices can be bid up and down on emotion) is the CME is fairly and generally reflective of supply and demand.

As can be seen from the above graph, covering 30 years, the CME has nothing to do with supply and demand. USDA's "Commercial Disappearances" reflects production and sales. Note though, it does not include imported dairy proteins.

The CME needs to be understood from an economic organizational perspective. The CME is a "leveraged price signal" from the powerful. Presently, there is no competitive milk or dairy product price. No matter how the data is collected, everyone will march lock step with the CME.

Furthermore, if margin insurance is in place, probably the CME will drop.

Sunday, January 16, 2011

Weather Event

The current La Nina seems to be having wide spread affects on the food supply.

http://www.accuweather.com/blogs/news/story/44427/extreme-weather-events-spark-f.asp

More at link.

http://www.cpc.ncep.noaa.gov/products/analysis_monitoring/enso_advisory/ensodisc.pdf

More at link.

Here is NOAA's page on La Nina:

http://www.cpc.ncep.noaa.gov/products/precip/CWlink/MJO/enso.shtml#forecast

If prices related entirely to supply and demand, dairy farmers should do well. Both milk and dairy beef prices should be high.

http://www.accuweather.com/blogs/news/story/44427/extreme-weather-events-spark-f.asp

A series of extreme weather events around the world have caused food production failures sparking fear of a global food crisis.

The U.N. Food and Agriculture Organization was forced to have emergency meetings to evaluate the growing food concerns. They blame extreme weather as one of the major factors for shortages, and that urgent action is necessary.

Extreme weather has affected the global food shortages on various levels. Since July 2010, prices on basic staples wheat, corn, soybeans and rice have reached record highs.

More at link.

http://www.cpc.ncep.noaa.gov/products/analysis_monitoring/enso_advisory/ensodisc.pdf

Likely La Niña impacts during January-March 2011 include suppressed convection over the westcentral tropical Pacific Ocean, and enhanced convection over Indonesia. Impacts in the United States include an enhanced chance of above-average precipitation in the Pacific Northwest, Northern Rockies (along with a concomitant increase in snowfall), Great Lakes, and Ohio Valley. Below-average precipitation is favored across the southwestern and southeastern states. An increased chance of below average temperatures is predicted for much of the West Coast and northern tier of states (excluding New England), and a higher possibility of above-average temperatures is forecast for much of the southern and central U.S. (see 3-month seasonal outlook released on December 16th , 20 10). While seasonaltemperature and precipitation patterns in the U.S. are strongly influenced by La Niña, these signals can be modified by other factors, such as the Arctic Oscillation (AO)/ North Atlantic Oscillation (NAO).

More at link.

Here is NOAA's page on La Nina:

http://www.cpc.ncep.noaa.gov/products/precip/CWlink/MJO/enso.shtml#forecast

If prices related entirely to supply and demand, dairy farmers should do well. Both milk and dairy beef prices should be high.

Saturday, January 15, 2011

Banks

In spite of dairy farm prices looking up, banks will continue to put brakes on expansion. Not only U.S. banks, but also, New Zealand banks.

http://www.stuff.co.nz/business/farming/4531024/Banks-keep-tight-rein-on-rural-lending

http://www.stuff.co.nz/business/farming/4531024/Banks-keep-tight-rein-on-rural-lending

Export commodity prices are sparkling but the outlook for the rural economy this year is "muddly", with banks keeping a stranglehold on farm lending and cashflows still tight, say sector specialists.

Global food prices lifted by 25 per cent last year and in Fonterra's first global online auction for the new year average dairy prices jumped 7 per cent.

But it will be 2012 before there is a rebalancing of overheated pre-recession land asset values and income, they say.

ANZ National Bank chief economist Cameron Bagrie says farm balance sheets look "a bit shoddy" despite "remarkably" high commodity prices, generating stronger incomes in the sector.

"Things will come together in 2012 but 2011 is going to be a bit of a muddly year."

Farmers will continue to concentrate on reducing debt this year. The outlook for 2011 is better than for last year but the sector is "in a halfway house", Mr Bagrie says. Next year farmers will have repaired their balance sheets and commodity prices are expected to still be strong, he says.

Market experts expect only a slight improvement in farm sale activity.

PGG Wrightson, the country's biggest rural real estate company, predicts more energy in the $10 million-plus farm market with farmers and other investors with cash teaming up to buy farms that would be operated like corporates, with shareholders and contracted management.

PGGW real estate manager Stuart Cooper says inquiry at this top end of the market increased last month. There were only five sales of big farms nationally last year compared with 60 in boom year 2008, he said.

Bank of New Zealand chief economist Tony Alexander says an indication of new economic life in the sector is a strong increase in tractor registrations last month.

More people, including syndicates, with capital and only some debt would enter the market this year, he believes.

But Waikato accountant Nigel McWilliam, a dairy specialist with Diprose Miller, says banks are responsible for the real estate market squeeze.

"Bank criteria for lending are making it so difficult to get deals across the line.

"We have farmers looking to borrow, and a number [of clients] looking to sell, and the banks are very involved with sale and purchase agreements, walking the property with the purchaser and then pouring cold water on the deal."

This is a far step from pre-recession days when banks were lending freely, including against land value appreciation, Mr McWilliam says.

ASB rural economist James Shortall says dairy and meat returns are generally strong but farmers' cost structures are still high because of increases in inputs like fertiliser.

Friday, January 14, 2011

NFDM

Today, January 14, 2011 the price of Grade A NFDM rose to $1.4325 per pound. There were an amazing 13 trades this week, where usually there are none. The prior weeks average was $1.2940 per pound.

The answer lies in Brazil with La Nina flooding in which more than 500 have died.

http://edition.cnn.com/2011/WORLD/americas/01/14/brazil.flooding/

The Brazilian government wants an immediate 66 million pounds of NFDM for emergency food relief. New Zealand is hit with another La Nina weather event reducing milk output.

The U.S. manufacturers stocks of NFDM in November were 127.9 million pounds.

This is a big deal. All bets are off. Still time for low ball risk management - if so inclined.

The answer lies in Brazil with La Nina flooding in which more than 500 have died.

http://edition.cnn.com/2011/WORLD/americas/01/14/brazil.flooding/

The Brazilian government wants an immediate 66 million pounds of NFDM for emergency food relief. New Zealand is hit with another La Nina weather event reducing milk output.

The U.S. manufacturers stocks of NFDM in November were 127.9 million pounds.

This is a big deal. All bets are off. Still time for low ball risk management - if so inclined.

Thursday, January 13, 2011

Markets

Today, at the CME, block Cheddar wet to $1.51 per pound. Grade A NFDM went up 2 1/4 cents to $1.3950 per pound. Butter remained at $2.10 per pound. Baring any significant change, dairy farm milk price will rise dramatically.

However, nobody hitched in from either coast to run CME prices up. It is the same crowd which has participated in running them down. they do what they do because they can.

In January 2007, I spoke at a meeting and put a slide up which showed where some big players thought milk price might go. At the peak I said this is where most dairy farmers will go to sleep. But, the important time to have a discussion about pricing system change is when the price is high.

However, nobody hitched in from either coast to run CME prices up. It is the same crowd which has participated in running them down. they do what they do because they can.

In January 2007, I spoke at a meeting and put a slide up which showed where some big players thought milk price might go. At the peak I said this is where most dairy farmers will go to sleep. But, the important time to have a discussion about pricing system change is when the price is high.

Wednesday, January 12, 2011

Dean Foods

Dean is looking for money:

"David Tepper’s hedge fund firm Appaloosa Management has started a brand new position in Dean Foods (NYSE:DF). Per a 13G filed with the SEC, the hedge fund disclosed a 7.35% ownership stake in DF with 13,396,536 shares due to trading on December 28th, 2010. The majority of shares are held in Appaloosa’s Palomino fund. You can view Appaloosa’s other investments in our newsletter, Hedge Fund Wisdom."

(more at link)

http://wallstcheatsheet.com/trading/david-tepper-buys-dean-foods.html

Dean Foods is also selling its yogurt business, which consist of three plants, to Schreiber Foods.

What next?

"David Tepper’s hedge fund firm Appaloosa Management has started a brand new position in Dean Foods (NYSE:DF). Per a 13G filed with the SEC, the hedge fund disclosed a 7.35% ownership stake in DF with 13,396,536 shares due to trading on December 28th, 2010. The majority of shares are held in Appaloosa’s Palomino fund. You can view Appaloosa’s other investments in our newsletter, Hedge Fund Wisdom."

(more at link)

http://wallstcheatsheet.com/trading/david-tepper-buys-dean-foods.html

Dean Foods is also selling its yogurt business, which consist of three plants, to Schreiber Foods.

What next?

Tuesday, January 11, 2011

Exports - No Help

(click on image to enlarge)

Exports are always held to be a boon to dairy farmers. The data suggests exports are no help at all, to the dairy farmer.

Monday, January 10, 2011

Dictator Game

The National Bureau of Economic Research (NBER)recently releasedWorking Paper 16645: "CONVENIENTLY UPSET: AVOIDING ALTRUISM BY DISTORTING BELIEFS ABOUT OTHERS" by, Rafael Di Tella and Ricardo Pérez-Truglia.

There are a vast number of economic "games" : http://en.wikipedia.org/wiki/Game_theory

Some games require that the, generally two, players share or they get nothing. An opposite of that is called the "dictator game." In the dictator game, one player decides if the other gets anything. The second player must accept the decision. The game tries to determine why the "dictator" gives anything.

A variation of the dictator game allows for a side deal on the part of the passive player. In this case the dictator comes up with a reason why the other player got so little. This sounds like farm milk pricing.

The paper begins with an old French quote, "He who wants to kill his dog, accuses it of rabies." The first sentence states, "Beliefs are central in many economic models."

The abstract for the paper states:

Certainly, the CME dictates milk price to farmers but, it seems to me that the very idea of risk management allows some "top dogs" to think farmers, really good, smart, dairy farmers can get by on thin air.

There are a vast number of economic "games" : http://en.wikipedia.org/wiki/Game_theory

Some games require that the, generally two, players share or they get nothing. An opposite of that is called the "dictator game." In the dictator game, one player decides if the other gets anything. The second player must accept the decision. The game tries to determine why the "dictator" gives anything.

A variation of the dictator game allows for a side deal on the part of the passive player. In this case the dictator comes up with a reason why the other player got so little. This sounds like farm milk pricing.

The paper begins with an old French quote, "He who wants to kill his dog, accuses it of rabies." The first sentence states, "Beliefs are central in many economic models."

The abstract for the paper states:

In this paper we present the results from a “corruption game” (a dictator game modified so that the second player can accept a side payment that reduces the overall size of the pie). Dictators (silently)treated to have the possibility of taking a larger proportion of the recipient’s tokens, take more of them. They were also more likely to report believing that the recipient would accept a low price in exchange for a side payment; and selected larger numbers as their best guess of the likely proportion of recipients acting “unfairly”. The results favor the hypothesis that people avoid altruistic actions by distorting beliefs about others.

Certainly, the CME dictates milk price to farmers but, it seems to me that the very idea of risk management allows some "top dogs" to think farmers, really good, smart, dairy farmers can get by on thin air.

Sunday, January 9, 2011

Don't Panic - Everything is OK

(click on image to enlarge)

Energy is very important to farming. What is the oil price going to do? Naturally, one might think that the Energy Information Agency (EIA) of the U.S. might know a thing or two.

http://www.eia.gov/neic/speeches/newell_12162010.pdf

The report from December 16, 2010 is similar to any other government report. Things are OK. Tomorrow is going to be pretty much like today only more so. No matter what, don't panic.

For sure with current monetary policy, the U.S. dollar will be low and therefore, oil prices will be high.

There is no panic in dairy farming - there is despair. There is no real discussion by policy makers on dairy because, the status quo is always preferred to the unknown.

Saturday, January 8, 2011

FFTF

National Milk Producers Federation (NMPF) is pushing hard for its Foundations for the Future (FFTF) program. Colin Peterson is their guy in congress who will make this happen.

NMPF plans to have legislation introduced in the spring.

At this point, the plan seems to be an effort to make certain nothing significant happens. That is probably the exciting part to Peterson. There is no change is price discovery, the insurance program is really all it boils down to. With no change in the power of the CME, why should the "market" give a decent price. However, it is not likely the additional insurance coverage will be as cheap as man may think once the payment to farmers becomes habitual.

Many details are yet to be revealed like other programs roping in dairy farmers. But, Kozak is determined to move full speed ahead.

The sad part is there is an obligation for those at the top to do more. Maybe this is just a mirror image of those on the bottom thinking someone else should do something about their low milk checks. The con game flourishes on few details and much ignorance.

NMPF plans to have legislation introduced in the spring.

At this point, the plan seems to be an effort to make certain nothing significant happens. That is probably the exciting part to Peterson. There is no change is price discovery, the insurance program is really all it boils down to. With no change in the power of the CME, why should the "market" give a decent price. However, it is not likely the additional insurance coverage will be as cheap as man may think once the payment to farmers becomes habitual.

Many details are yet to be revealed like other programs roping in dairy farmers. But, Kozak is determined to move full speed ahead.

The sad part is there is an obligation for those at the top to do more. Maybe this is just a mirror image of those on the bottom thinking someone else should do something about their low milk checks. The con game flourishes on few details and much ignorance.

Friday, January 7, 2011

Invisible Hand

Adam Smith is the so-called father of capitalism. Generally,the let business be crowd likes to refer to Smith's idea of the invisible hand. The moneyed people like to promote the idea that if you only keep the government out of economic activity, the invisible hand will work for everyone's good.

This is a gross misrepresentation of Smith's thoughts. In Smith's "Wealth of Nations", Book IV, Chapter II, Smith stated:

Smith was cautioning against the risk of trade (today's globalism).

Dairy is a perfect example where there is no public, or dairy farmer, benefit from world trade.

This is a gross misrepresentation of Smith's thoughts. In Smith's "Wealth of Nations", Book IV, Chapter II, Smith stated:

But the annual revenue of every society is always precisely equal to the exchangeable value of the whole annual produce of its industry, or rather is precisely the same thing with that exchangeable value. As every individual, therefore, endeavours as much as he can both to employ his capital in the support of domestic industry, and so to direct that industry that its produce may be of the greatest value; every individual necessarily labours to render the annual revenue of the society as great as he can. He generally, indeed, neither intends to promote the public interest, nor knows how much he is promoting it. By preferring the support of domestic to that of foreign industry, he intends only his own security; and by directing that industry in such a manner as its produce may be of the greatest value, he intends only his own gain, and he is in this, as in many other cases, led by an invisible hand to promote an end which was no part of his intention. Nor is it always the worse for the society that it was no part of it. By pursuing his own interest he frequently promotes that of the society more effectually than when he really intends to promote it. I have never known much good done by those who affected to trade for the public good. It is an affectation, indeed, not very common among merchants, and very few words need be employed in dissuading them from it.

Smith was cautioning against the risk of trade (today's globalism).

Dairy is a perfect example where there is no public, or dairy farmer, benefit from world trade.

Thursday, January 6, 2011

Too Late?

Today, the news seemed to be good new. Butter up 20 cents. NFDM futures up the limit.

An article in the Capital Press : http://www.capitalpress.com/dairy/CRD-dairy-finance-w-logo-010711

with the headline, "Wells Fargo: Credit still flowing" is hard to believe. For all practical purposes, banks have cut dairies off. Equity is gone.

From the late 1800s:

http://www.lizlyle.lofgrens.org/RmOlSngs/FarmerManTab.pdf

An article in the Capital Press : http://www.capitalpress.com/dairy/CRD-dairy-finance-w-logo-010711

with the headline, "Wells Fargo: Credit still flowing" is hard to believe. For all practical purposes, banks have cut dairies off. Equity is gone.

From the late 1800s:

http://www.lizlyle.lofgrens.org/RmOlSngs/FarmerManTab.pdf

When the farmer comes to town

With his wagon broken down,

The farmer is the man who feeds them all.

If you'll only look and see,

I am sure you will agree,

The farmer is the man who feeds them all.

The farmer is the man (x2)

Lives on credit till the fall,

Then they take him by the hand,

And they lead him from the land,

And the middleman's the man who gets it all.

When the lawyer hangs around

While the butcher cuts a pound,

The farmer is the man who feeds them all.

And the preacher and the cook

Go a-strolling down the brook,

The farmer is the man who feeds them alt.

The farmer is the man (x2)

Lives on credit till the fall.

With the interest rate so high,

It's a wonder he don't die;

The banker is the man who gets it all.

When the banker says he's broke,

And the merchant's up in smoke,

The farmer is the man who feeds them all.

It would put them to the test

If the farmer took a rest.

The farmer is the man who feeds them all.

The farmer is the man (x2)

Lives on credit till the fall,

His clothes are wearing thin,

His condition is a sin;

He's forgot that he's the man who feeds them all.

Wednesday, January 5, 2011

Milkweed Site

The Milkweed web site is down and will soon move to another server. Sorry for any inconveniences.

Corn and Soy

Today I spoke with someone who is really tuned to markets. He thinks the hedge funds will jump out of grain into equities and grain prices will fall.

The other view is:

more can be found at: http://online.wsj.com/article/SB10001424052970204204004576049932838994642.html

So, take your pick of theories. I think the big problem is and will continue to be credit.

The other view is:

Scorching summer heat in South America is cutting harvest forecasts in one of the world's key farm belts, helping propel crop prices to two-year highs and fueling concerns about tight global supplies.

Dry weather caused by the La Niña weather pattern is already damaging fields in Argentina, which will be the world's second-largest corn exporter this crop year and third-largest soybean exporter, according to U.S. data. With temperatures reaching into the 90s, weather is also threatening crops in southern Brazil and Uruguay, which declared a state of emergency last week for farmers in the north of the country. The region's role in world food markets means any production problems there could be felt around the world.

more can be found at: http://online.wsj.com/article/SB10001424052970204204004576049932838994642.html

So, take your pick of theories. I think the big problem is and will continue to be credit.

Tuesday, January 4, 2011

Latest GDT Prices

(click on image to enlarge)

As can be seen above, Fonterra's globaldairy Trade auction held today saw prices rise dramatically.

Of particular interest is the skim milk powder, which is essentially interchangeable with NFDM. In the latest NASS dairy Products report NFDM prices fell just over 6%.

Highway robbery.

Monday, January 3, 2011

DairyProducts

At:

http://usda.mannlib.cornell.edu/usda/current/DairProd/DairProd-01-03-2011.pdf

is the latest dairy products report through November 2010.

Cumulatively, there has been 3.3% more cheese produced. But, whey, which is a by product of cheese making and should rise and fall proportionately with cheese, is only up 1.4%.

There is something rotten in the state of Denmark, as Shakespeare noted.

http://usda.mannlib.cornell.edu/usda/current/DairProd/DairProd-01-03-2011.pdf

is the latest dairy products report through November 2010.

Cumulatively, there has been 3.3% more cheese produced. But, whey, which is a by product of cheese making and should rise and fall proportionately with cheese, is only up 1.4%.

There is something rotten in the state of Denmark, as Shakespeare noted.

Sunday, January 2, 2011

National Importance

http://www.stuff.co.nz/business/farming/4508171/Dairys-3-6b-contribution-to-NZ-economy

"So let's break with the New Zealand tradition of cutting down our tall poppies. Let's celebrate our dairy industry's success on the global stage, and appreciate Fonterra and the dairy industry as an achiever that makes a difference to our everyday lives."

The full report is at:

http://www.fonterra.com/wps/wcm/connect/fcf7000044f43b8bb2b2fbac5c5d2692/NZIER+economic+report+to+Fonterra+and+DNZ+2010.pdf?MOD=AJPERES&CACHEID=fcf7000044f43b8bb2b2fbac5c5d2692

"We don't get no respect"

"So let's break with the New Zealand tradition of cutting down our tall poppies. Let's celebrate our dairy industry's success on the global stage, and appreciate Fonterra and the dairy industry as an achiever that makes a difference to our everyday lives."

The full report is at:

http://www.fonterra.com/wps/wcm/connect/fcf7000044f43b8bb2b2fbac5c5d2692/NZIER+economic+report+to+Fonterra+and+DNZ+2010.pdf?MOD=AJPERES&CACHEID=fcf7000044f43b8bb2b2fbac5c5d2692

"We don't get no respect"

Saturday, January 1, 2011

The Pie

(click on image to enlarge)

At: http://www.agweb.com/assets/1/6/D10188.pdf

is an interesting presentation.

The fact is the dairy pie is finite, with a limited amount of money. If you believe the above presentation, you might be led to think any and all can be winners. Not so. The game being played is a zero sum game, meaning, for there to be winners there must be losers. "Am I my brother's keeper?" (Gen 4:9)

What is the fate of the losers? Do they disappear, blown away like characters on a video game?

I would hope this year we can put more of an effort into seeing the importance of all in the dairy community.

Subscribe to:

Posts (Atom)