(click on image to enlarge)

The good news is that full service restaurants are doing quite well - at least according to the Bloomberg Index.

However, the New York Times has an article should be read:

http://www.nytimes.com/2010/11/07/us/07fat.html?pagewanted=1&_r=1&hpw

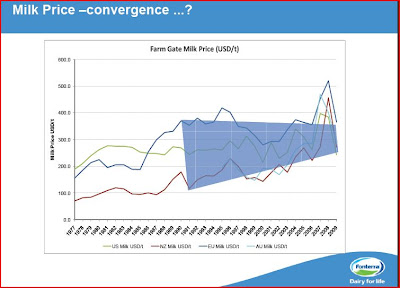

The article has generated a great deal of backlash against dairy farmers on Twitter. Naturally, the article should be of concern. But, has the increase in per capita cheese consumption really benefited dairy farmers?

Funny, there seems to be no problem in France with cheese consumption and obesity.